Sallie Mae 2006 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

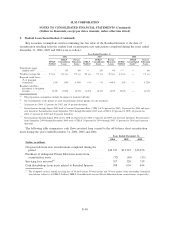

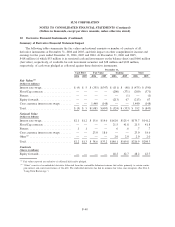

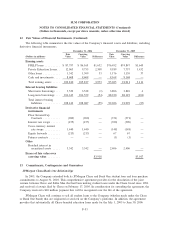

10. Derivative Financial Instruments (Continued)

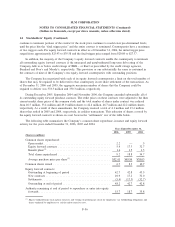

Summary of Derivative Financial Statement Impact

The following tables summarize the fair values and notional amounts or number of contracts of all

derivative instruments at December 31, 2006 and 2005, and their impact on other comprehensive income and

earnings for the years ended December 31, 2006, 2005 and 2004. At December 31, 2006 and 2005,

$418 million (of which $53 million is in restricted cash and investments on the balance sheet) and $666 million

(fair value), respectively, of available-for-sale investment securities and $28 million and $249 million,

respectively, of cash were pledged as collateral against these derivative instruments.

2006 2005 2006 2005 2006 2005 2006 2005

Cash Flow Fair Value Trading Total

December 31,

Fair Values

(1)

(Dollars in millions)

Interest rate swaps ................... $ (9) $ 5 $ (355) $(347) $ (111) $ (48) $ (475) $ (390)

Floor/Cap contracts . . . ............... — — — — (200) (371) (200) (371)

Futures ........................... — — — — — (1) — (1)

Equity forwards ..................... — — — — (213) 67 (213) 67

Cross currency interest rate swaps ....... — — 1,440 (148) — — 1,440 (148)

Total ............................. $ (9) $ 5 $1,085 $(495) $ (524) $ (353) $ 552 $ (843)

Notional Value

(Dollars in billions)

Interest rate swaps ................... $2.1 $1.2 $ 15.6 $14.6 $162.0 $125.4 $179.7 $141.2

Floor/Cap contracts . . . ............... — — — — 21.5 41.8 21.5 41.8

Futures ........................... .1 .1 — — .6 .6 .7 .7

Cross currency interest rate swaps ....... — — 23.0 18.6 — — 23.0 18.6

Other

(2)

........................... — — — — 2.0 2.0 2.0 2.0

Total ............................. $2.2 $1.3 $ 38.6 $33.2 $186.1 $169.8 $226.9 $204.3

Contracts

(Shares in millions)

Equity forwards ..................... — — — — 48.2 42.7 48.2 42.7

(1)

Fair values reported are exclusive of collateral held and/or pledged.

(2)

“Other” consists of an embedded derivative bifurcated from the convertible debenture issuance that relates primarily to certain contin-

gent interest and conversion features of the debt. The embedded derivative has had de minimis fair value since inception. (See Note 8,

“Long-Term Borrowings.”)

F-48

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)