Sallie Mae 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.a result of the school using the FDLP rather than the FFELP. The bill provides that schools could use such

payments to supplement the amount awarded to Pell Grant recipients or could use such payment for grants to

low- or middle-income graduate students. Schools would be required to join the Direct Loan Program for five

years from the date the first payment is made to qualify for the payments. Because payments would be

contingent on available funding, schools switching from the FFELP to the FDLP would be paid first and, then,

other FDLP schools, if funds remained, would be paid on a pro-rata basis.

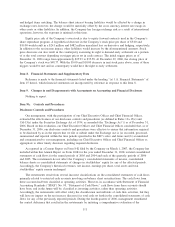

President’s 2008 Budget Proposals

On February 5, 2007, President Bush transmitted his fiscal 2008 budget proposals to Congress. The

budget included several proposals that would reduce or alter payments to both lenders and guarantors in the

FFELP. The specific proposals include: (1) reducing special allowance payments on new loans by 0.50 percent-

age points; (2) reducing the default guaranty from 97 percent to 95 percent; (3) reducing payments to

Exceptional Performers by two percentage points; (4) doubling lender origination fee for FFELP Consolidation

Loans, from 0.5 percent to 1.0 percent; (5) reducing collections retention to 16 percent beginning in fiscal

2008; (6) reducing administrative cost allowance payments to guaranty agencies, changing the formula from a

percent of original principal to a unit cost basis; and (7) eliminating the Perkins loan program.

If enacted in their current form, and the Company takes no remedial action, the FFELP programs cuts

proposed in the President’s budget proposal detailed above, which are to be implemented prospectively, could

over time have a materially adverse affect on our financial condition and results of operations, as new loans

originated under the new proposal become a higher percentage of the portfolio.

Student Loan Sunshine Act

In February 2007, the “Student Loan Sunshine Act” was introduced in both the House and Senate with

the stated purpose of protecting student loan borrowers by providing them with more information and

disclosures about private student loans. The bill applies to all lenders that make private educational loans

through colleges and universities, as well as to lenders of direct-to-consumer educational loans. The bill’s

provisions also apply to post-secondary educational institutions that receive federal funds. The legislation

would impose significant new disclosure and reporting requirements on schools and lenders and would prohibit

gifts with a value greater than $10 from lenders to financial aid professionals. The legislation would require

schools to include at least three unaffiliated lenders on any preferred lender list. The legislation would amend

the “Truth in Lending” Act to require lenders to notify the school if their student, or parent of their student,

applies for a private education loan, regardless of whether the lender has an education loan arrangement with

the school, and to require the school to notify the prospective borrower whether and to what extent the private

education loan exceeds the cost of attendance, after consideration of all federal, state and institutional aid that

the borrower has or is eligible to receive.

If the Student Loan Sunshine Act is enacted in its current form, it could negatively impact the financial

aid process and the timely disbursement of private education loans, including the efficiency of direct-to-

consumer loans, for borrowers at post-secondary education institutions, all of which could adversely affect our

results of operations. In addition, the bill could adversely affect the strategy under which our primary

marketing point of contact is the school’s financial aid internal brand originations.

Student Debt Relief Act of 2007

On January 22, 2007, Senator Edward Kennedy (D-MA) introduced the Student Debt Relief Act of 2007

(S. 359) along with Senators Durbin (D-IL), Lieberman (D-CT), Mikulski (D-MD), Obama (D-IL), and

Schumer (D-NY) as co-sponsors. The proposed legislation would, in addition to increasing Pell grants and

providing other benefits to student loan borrowers,

• once again allow in-school loan consolidation and allow “reconsolidation” of FFELP Consolidation

Loans;

• make charging Direct Loan origination fees subject to the discretion of the Secretary of Education; and,

106