Sallie Mae 2006 Annual Report Download - page 14

Download and view the complete annual report

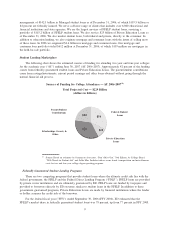

Please find page 14 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.lenders ($4.5 billion). FFELP Consolidation Loans now represent 71 percent of our on-balance sheet federally

guaranteed student loan portfolio and over 66 percent of our Managed federally guaranteed portfolio.

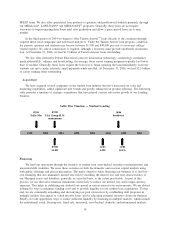

During 2006, we implemented a new loan acquisition strategy under which we began purchasing a

significant amount of FFELP Consolidation Loans, primarily via the spot market, which augments our

traditional FFELP Consolidation Loan origination process. We refer to this new loan acquisition strategy as

our Wholesale Consolidation Channel. The decision to implement this strategy stems from the repeal of the

Single Holder Rule in 2006 which allowed the industry to compete for student loans held by one lender. This

has caused many originators to sell loans sooner and more frequently. At December 31, 2006, Wholesale

Consolidation Loans totaled $3.6 billion.

The increased activity in FFELP Consolidation Loans has led to demand for the consolidation of Private

Education loans. Private Education Consolidation Loans provide an attractive refinancing opportunity to

certain borrowers because they allow borrowers to lower their monthly payments and extend the life of the

loan. During 2006, we internally consolidated $300 million of our Managed Private Education loans, and

added net $50 million in new volume.

GradPLUS

The Deficit Reduction Act of 2005 expanded the existing Federal PLUS loan to graduate and professional

students (“GradPLUS Loans”). Previously, PLUS loans were restricted to parents of dependent, undergraduate

students.

GradPLUS Loans have a lower rate of interest than our Private Education Loans and they allow graduate

and professional students to borrow up to the full cost of their education (tuition, room and board), less other

financial aid received. We therefore expect that over time GradPLUS Loans will supplant a significant amount

of our Private Education Loans to graduate and professional students. In 2006, GradPLUS loans represented

one percent of Preferred Channel Originations or $246 million.

Private Education Loans

The rising cost of education has led students and their parents to seek additional private credit sources to

finance their education. Private Education Loans are often packaged as supplemental or companion products to

FFELP loans and priced and underwritten competitively to provide additional value for our school relation-

ships. In certain situations, a for-profit school shares the borrower credit risk. Over the last several years, the

growth of Private Education Loans has accelerated due to tuition increasing faster than the rate of inflation

coupled with stagnant FFELP lending limits. This rapid growth combined with the relatively higher spreads

has led to Private Education Loans contributing a higher percentage of our net interest margin in each of the

last four years. We expect this trend to continue in the foreseeable future. In 2006, Private Education Loans

contributed 23 percent of the overall “Core Earnings” net interest income after provisions, up from 17 percent

in 2005. The Higher Education Reconciliation Act of 2005 increased FFELP loan limits in AY 2006-2007.

This, along with the introduction of GradPLUS Loans discussed above, will reduce the rate of growth in

Private Education Loans in the future. We believe this loss of future Private Education Loan volume for

graduate students will be replaced by an increase in federally insured loans.

Since we bear the full credit risk for Private Education Loans, they are underwritten and priced according

to credit risk based upon standardized consumer credit scoring criteria. We mitigate some of this credit risk by

providing price and eligibility incentives for students to obtain a credit-worthy co-borrower, and approximately

50 percent of our Private Education Loans have a co-borrower. Due to their higher risk profile, Private

Education Loans earn higher spreads than their FFELP loan counterparts. In 2006, Private Education Loans

earned an average “Core Earnings” spread, before provisions for loan losses, of 5.13 percent versus an average

“Core Earnings” spread of 1.26 percent for FFELP loans, excluding the impact of the Wholesale Consolidation

portfolio.

Our largest Private Education Loan program is the Signature Loan», which is offered to undergraduates

and graduates through the financial aid offices of colleges and universities and packaged with traditional

13