Sallie Mae 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Because of the risks, uncertainties and conditions described above, there can be no assurance that we can

maintain our future growth rates at rates consistent with our historic growth rates.

Our GAAP earnings are highly susceptible to changes in interest rates because most of our derivatives do

not qualify for hedge accounting treatment under SFAS No. 133.

Changes in interest rates can cause volatility in our GAAP earnings as a result of changes in the market

value of our derivatives that do not qualify for hedge accounting treatment under SFAS No. 133, “Accounting

for Derivative Instruments and Hedging Activities.” Under SFAS No. 133, changes in derivative market values

are recognized immediately in earnings. If a derivative instrument does not qualify for hedge accounting

treatment under SFAS No. 133, there is no corresponding change in the fair value of the hedged item

recognized in earnings. As a result, gain or loss recognized on a derivative will not be offset by a

corresponding gain or loss on the underlying hedged item. Because most of our derivatives do not qualify for

hedge accounting treatment, when interest rates change significantly, our GAAP earnings may fluctuate

significantly.

For a discussion of operational, market and interest rate, and liquidity risks, see “MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS —

RISKS.”

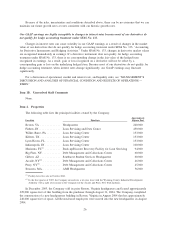

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

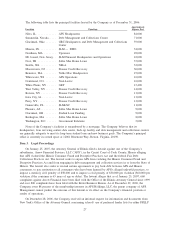

The following table lists the principal facilities owned by the Company:

Location Function

Approximate

Square Feet

Reston, VA ............. Headquarters 240,000

Fishers, IN .............. Loan Servicing and Data Center 450,000

Wilkes Barre, PA ......... Loan Servicing Center 133,000

Killeen, TX ............. Loan Servicing Center 133,000

Lynn Haven, FL .......... Loan Servicing Center 133,000

Indianapolis, IN .......... Loan Servicing Center 100,000

Marianna, FL

(1)

.......... Back-up/Disaster Recovery Facility for Loan Servicing 94,000

Big Flats, NY ............ Debt Management and Collections Center 60,000

Gilbert, AZ ............. Southwest Student Services Headquarters 60,000

Arcade, NY

(2)

........... Debt Management and Collections Center 46,000

Perry, NY

(2)

............. Debt Management and Collections Center 45,000

Swansea, MA............ AMSHeadquarters 36,000

(1)

Facility listed for sale in October 2006.

(2)

In the first quarter of 2003, the Company entered into a ten year lease with the Wyoming County Industrial Development

Authority with a right of reversion to the Company for the Arcade and Perry, New York facilities.

In December 2003, the Company sold its prior Reston, Virginia headquarters and leased approximately

229,000 square feet of that building from the purchaser through August 31, 2004. The Company completed

the construction of a new headquarters building in Reston, Virginia in August 2004 that has approximately

240,000 square feet of space. All Reston-based employees were moved into the new headquarters in August

2004.

26