Sallie Mae 2006 Annual Report Download - page 109

Download and view the complete annual report

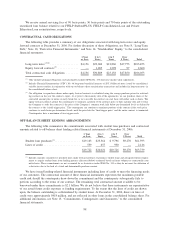

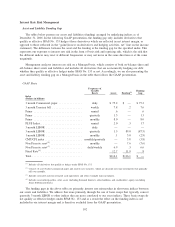

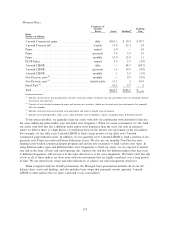

Please find page 109 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FFELP loans made or acquired with funds derived from tax-exempt obligations are eligible for 9.5 percent

SAP. The letter’s restatement is consistent with claims asserted by the ED’s Office of Inspector General

(“OIG”) in their Final Audit Report on “Special Allowance Payments to Nelnet for Loans Funded by Tax-

Exempt Obligations” issued on September 29, 2006. On January 24, 2007, ED sent a letter to the Company

which sets forth the same restatement and also imposes audit and certification requirements for any 9.5 percent

SAP billings after September 30, 2006. On February 15, 2007, the Company delivered a letter to ED, which,

subject to certain conditions, including no successful challenge by an industry participant of ED’s restated

eligibility requirements for 9.5 percent SAP, stated that the Company would make no further claims for

9.5 percent SAP retroactive to October 1, 2006, and for those loans affected, would bill at the standard SAP

rate. In the fourth quarter of 2006, the Company accrued $2.4 million in interest income in excess of income

based upon the standard special allowance rate on its portfolio of loans that is entitled to receive 9.5 percent

SAP. After adjusting for the fourth quarter accrual, we earned a total of $13.1 million in interest income in

excess of standard special allowance payments during 2006. Regardless of the issuance of the “Dear Colleague

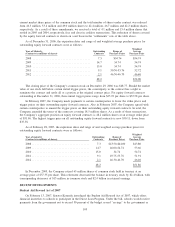

Letter,” the Company’s portfolio of 9.5 percent loans and associated SAP billings have been in a constant state

of decline. As a result, our voluntary forgoing of future claims of 9.5 percent SAP will not have a material

impact on future earnings. In addition, we will record an impairment of $9 million related to the intangible

asset associated with the 9.5 percent loans acquired in business combinations.

Extension of the Higher Education Act

On September 30, 2006, the President signed into law P.L. 109-292, the Third Extension of the Higher

Education Act (“HEA”), temporarily authorizing the rest of HEA until June 30, 2007. Included in the

extension were several modifications to provisions passed in the Deficit Reduction Act of 2005. The first

provision further limited the ability of schools to act as lenders in the FFELP, requiring that the statutory

restrictions on “school as lender” apply to schools using “eligible lender trusts.” Another provision clarified

the rate for the Account Maintenance Fee paid to guaranty agencies.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

See Note 2 to the consolidated financial statements, “Significant Accounting Policies — Recently Issued

Accounting Pronouncements.”

108