Sallie Mae 2006 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

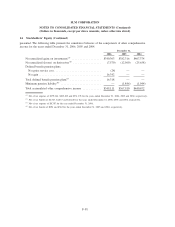

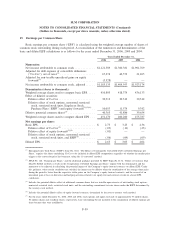

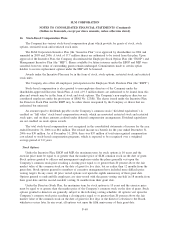

14. Stockholders’ Equity (Continued)

continue to terminate portions of the contract if the stock price continues to reach lower pre-determined levels,

until the price hits the “final trigger price” and the entire contract is terminated. Counterparties have a maximum

of two triggers each. For equity forward contracts in effect as of December 31, 2006, the initial trigger price

ranged from approximately $25.93 to $35.58 and the final trigger price ranged from $20.84 to $27.37.

In addition, the majority of the Company’s equity forward contracts enable the counterparty to terminate

all outstanding equity forward contracts if the unsecured and unsubordinated long-term debt rating of the

Company falls to or below credit ratings of BBB⫺or Baa3 as prescribed by the credit ratings agencies,

Standard and Poor’s and Moody’s, respectively. This provision or one substantially the same is contained in

the contracts of nine of the Company’s ten equity forward counterparties with outstanding positions.

The Company has negotiated with each of its equity forward counterparties a limit on the total number of

shares that may be required to be delivered to that counterparty in net share settlement of the transactions. As

of December 31, 2006 and 2005, the aggregate maximum number of shares that the Company could be

required to deliver was 378.3 million and 330.3 million, respectively.

During December 2005, September 2004 and November 2004, the Company amended substantially all of

its outstanding equity forward purchase contracts. The strike prices on these contracts were adjusted to the then

current market share prices of the common stock and the total number of shares under contract was reduced

from 46.5 million, 53.4 million and 49.0 million shares to 42.4 million, 46.7 million and 42.2 million shares,

respectively. As a result of these amendments, the Company received a total of 4.1 million and 13.4 million

shares that settled in 2005 and 2004, respectively, in cashless transactions. This reduction of shares covered by

the equity forward contracts is shown on a net basis in the “settlements” row of the table below.

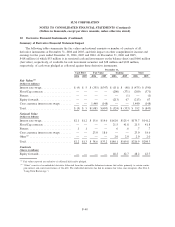

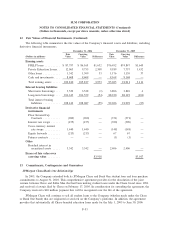

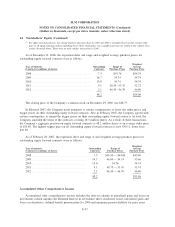

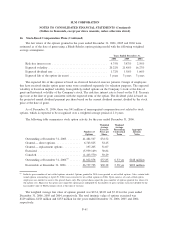

The following table summarizes the Company’s common share repurchase, issuance and equity forward

activity for the years ended December 31, 2006, 2005 and 2004.

2006 2005 2004

Years Ended December 31,

(Shares in millions)

Common shares repurchased:

Open market .......................................... 2.2 — .5

Equity forward contracts ................................. 5.4 17.3 32.7

Benefit plans

(1)

........................................ 1.6 1.5 1.5

Total shares repurchased ................................. 9.2 18.8 34.7

Average purchase price per share

(2)

......................... $52.41 $49.94 $38.03

Common shares issued .................................... 6.7 8.3 10.7

Equity forward contracts:

Outstanding at beginning of period ......................... 42.7 42.8 43.5

New contracts ......................................... 10.9 17.2 32.0

Settlements ........................................... (5.4) (17.3) (32.7)

Outstanding at end of period .............................. 48.2 42.7 42.8

Authority remaining at end of period to repurchase or enter into equity

forwards ............................................. 15.7 18.7 35.8

(1)

Shares withheld from stock option exercises and vesting of performance stock for employees’ tax withholding obligations and

shares tendered by employees to satisfy option exercise costs.

F-56

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)