Sallie Mae 2006 Annual Report Download - page 26

Download and view the complete annual report

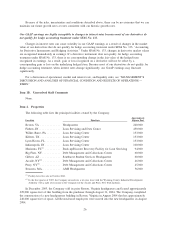

Please find page 26 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operations — could be adversely affected. We bear the full risk of loss on our portfolio of Private Education

Loans. A prolonged economic downturn could make it difficult for borrowers to meet their payment

obligations for a variety of reasons, including job loss and underemployment. In addition, a prolonged

economic downturn could extend the amortization period on DMO’s purchased receivables.

We face strong competition in all of our businesses, particularly in our FFELP business. For example, a

number of direct-to-consumer firms entered the market for FFELP Consolidation Loans in recent years in

response to increased borrower demand and low barriers to entry. There can also be no assurance that

significantly more such firms will not enter the market for FFELP Consolidation Loans, which could result in

higher than expected prepayments on our FFELP loan portfolio. (See “MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — LENDING BUSI-

NESS SEGMENT — Trends in the Lending Business Segment.”) Such prepayments would adversely impact

our earnings. We also expect to see more competition in our Private Education Loan business. The strong

margins that we currently maintain in this growing business that offset some of the margin erosion that we

have experienced in our FFELP business may begin to weaken as more competitors offer competing products.

If these competitive trends intensify, we could face further margin pressure.

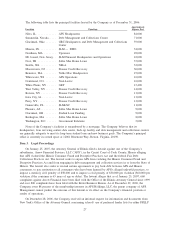

Because we earn our revenues from federally insured loans under a federally sponsored loan program, we

are subject to political and regulatory risk. As part of the HEA, the student loan program is periodically

amended and must be “reauthorized” every six years. Past legislative changes included reduced loan yields

paid to lenders (1986, 1992, 1995 and 1998), increased fees paid by lenders (1993), decreased level of the

government guaranty (1993) and reduced fees to guarantors and collectors, among others. On February 8,

2006, the President signed the Reconciliation Legislation. The Reconciliation Legislation contains a number of

provisions that over time will reduce our earnings on FFELP student loans, including a requirement that

lenders rebate Floor Income on new loans and a reduction in lender reinsurance. In addition, since January 1,

2007, several bills have been introduced in both houses of Congress that would be, if enacted in their current

forms, materially adverse to the profitability of the FFELP industry and create incentives for post-secondary

schools to participate in the FDLP rather than the FFELP. The President’s 2008 budget proposals also call for,

among other things, a 50 basis point cut in special allowance payments. Finally, there can be no assurances

that future reauthorizations and other political developments will not result in changes that have a materially

adverse impact on the Company. (For further discussion see “MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — RECENT

DEVELOPMENTS”.)

Our principal business is comprised of acquiring, originating, holding and servicing education loans made

and guaranteed under the FFELP. Most significant aspects of our principal business are governed by the HEA.

We must also meet various requirements of the guaranty agencies, which are private not-for-profit organiza-

tions or state agencies that have entered into federal reinsurance contracts with ED, to maintain the federal

guarantee on our FFELP loans. These requirements establish origination and servicing requirements, proce-

dural guidelines and school and borrower eligibility criteria. The federal guarantee of FFELP loans is

conditioned on loans being originated, disbursed or serviced in accordance with ED regulations.

If we fail to comply with any of the above requirements, we could incur penalties or lose the federal

guarantee on some or all of our FFELP loans. In addition, our marketing practices are subject to the HEA’s

prohibited inducement provision and our failure to comply with such regulation could subject us to a

limitation, suspension or termination of our eligible lender status. Even if we comply with the above

requirements, a failure to comply by third parties with whom we conduct business could result in us incurring

penalties or losing the federal guarantee on some or all of our FFELP loans. If we experience a high rate of

servicing deficiencies, we could incur costs associated with remedial servicing, and, if we are unsuccessful in

curing such deficiencies, the eventual losses on the loans that are not cured could be material. Failure to

comply with these laws and regulations could result in our liability to borrowers and potential class action

suits, all of which could adversely affect our future growth rates. An additional consequence of servicing

deficiencies would be the loss of our Exceptional Performer Designation.

25