Sallie Mae 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in consolidations to third parties in 2006 reflects FFELP lenders reconsolidating FFELP

Consolidation Loans using the Direct Loan program as a pass-through entity, a practice which was severely

restricted by The Higher Education Reconciliation Act of 2005 as of July 1, 2006. The increase also reflects

the effect of the repeal of the single holder rule, which was effective for applications received on or after

June 15, 2006. The single-holder rule had previously required that when a lender held all of the FFELP

Stafford loans of a particular borrower whose loans were held by a single lender, in most cases that borrower

could only obtain a FFELP Consolidation Loan from that lender.

During 2006, Private Education Loan consolidations were introduced as a separate product line and

during the year we had $50 million of net incremental volume on a Managed Basis. We expect this product

line to grow in the future and will aggressively protect our portfolio against third-party consolidation of Private

Education Loans.

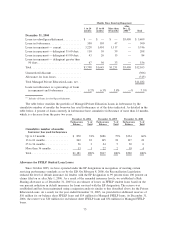

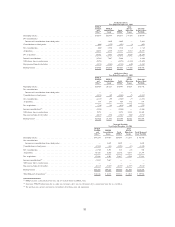

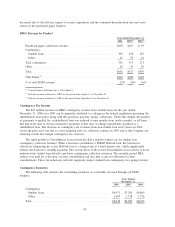

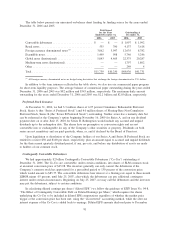

Other Income — Lending Business Segment

The following table summarizes the components of other income, net, for our Lending business segment

for the years ended December 31, 2006, 2005 and 2004.

2006 2005 2004

Years Ended

December 31,

Late fees ................................................... $107 $ 89 $ 92

Gains on sales of mortgages and other loan fees...................... 15 18 22

Losses on securities, net ....................................... (4) (36) (23)

Other ..................................................... 59 40 40

Total other income, net ........................................ $177 $111 $131

Other income in 2006 includes a settlement received on the final disposition of leveraged leases for which

we had previously reserved, plus an increase in forbearance fees.

The net losses on securities in 2005 and 2004 primarily relate to a $39 million leveraged lease

impairment for an aircraft leased to Northwest Airlines and a $27 million impairment for aircraft leased to

Delta Airlines, respectively. At December 31, 2006, we had investments in leveraged and direct financing

leases, net of impairments, totaling $109 million that are the general obligations of American Airlines and

Federal Express Corporation. Based on an analysis of the potential losses on certain leveraged leases plus the

increase in current tax obligations related to the forgiveness of debt obligations and/or the taxable gain on the

sale of the aircraft, our remaining after-tax accounting exposure from our investment in leveraged leases was

$69 million at December 31, 2006, of which $52 million relates to American Airlines.

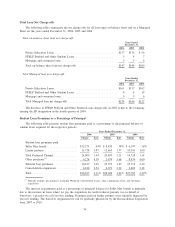

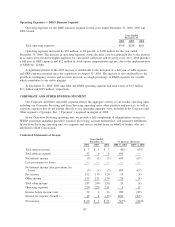

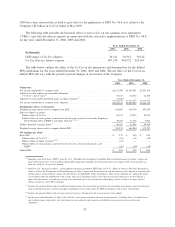

Operating Expense — Lending Business Segment

The following table summarizes the components of operating expenses for our Lending business segment

for the years ended December 31, 2006, 2005 and 2004.

2006 2005 2004

Years Ended

December 31,

Sales and originations ......................................... $327 285 $259

Servicing and information technology ............................. 201 193 150

Corporate overhead ........................................... 117 69 78

Total operating expenses ....................................... $645 $547 $487

Loss on GSE debt extinguishment and defeasance .................... $ — $ — $221

82