Sallie Mae 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215

|

|

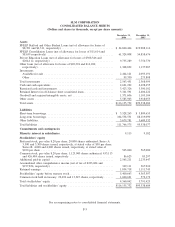

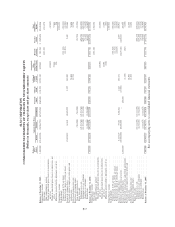

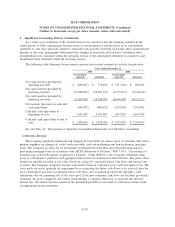

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Dollars in thousands, except share and per share amounts)

Preferred

Stock

Shares Issued Treasury Outstanding

Preferred

Stock

Common

Stock

Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Treasury

Stock

Total

Stockholders’

Equity

Common Stock Shares

Balance at December 31, 2005 ................ 7,300,000 426,483,527 (13,346,717) 413,136,810 $565,000 $85,297 $2,233,647 $367,910 $1,111,743 $ (572,172) $3,791,425

Comprehensive income:

Net income . . . ........................ 1,156,956 1,156,956

Other comprehensive income:

Change in unrealized gains (losses) on investments,

netoftax ......................... (41,953) (41,953)

Change in unrealized gains (losses) on derivatives,

netoftax ......................... 4,990 4,990

Minimum pension liability adjustment, net of tax . . . (569) (569)

Comprehensive income . . .................... 1,119,424

Adjustment to initially apply SFAS No. 158, net of

tax............................... 18,733 18,733

Cash dividends:

Common stock ($.97 per share) ............... (398,414) (398,414)

Preferred stock, Series A ($3.48 per share) . . . ..... (11,500) (11,500)

Preferred stock, Series B ($5.82 per share) . . . ..... (23,420) (23,420)

Issuance of common shares ................... 6,629,455 64,141 6,693,596 1,326 204,996 3,499 209,821

Preferred stock issuance costs and related amortization . . . 647 (647) —

Tax benefit related to employee stock option and purchase

plan . . . ............................. 54,522 54,522

Stock-based compensation cost . . ............... 71,399 71,399

Repurchase of common shares:

Open market repurchases ................... (2,159,827) (2,159,827) (100,000) (100,000)

Equity forwards:

Settlement cost, cash .................... (5,395,979) (5,395,979) (295,376) (295,376)

(Gain)/loss on settlement . . . ............... — — 10,907 10,907

Benefit plans . ........................ (1,657,788) (1,657,788) (87,479) (87,479)

Balance at December 31, 2006 ................ 7,300,000 433,112,982 (22,496,170) 410,616,812 $565,000 $86,623 $2,565,211 $349,111 $1,834,718 $(1,040,621) $4,360,042

See accompanying notes to consolidated financial statements.

F-8