Sallie Mae 2006 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

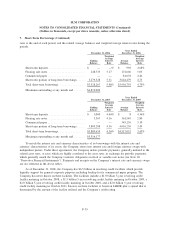

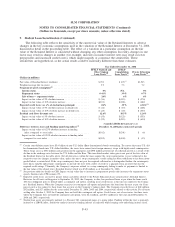

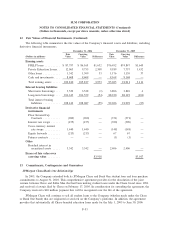

9. Student Loan Securitization (Continued)

The following table reflects the sensitivity of the current fair value of the Retained Interests to adverse

changes in the key economic assumptions used in the valuation of the Retained Interest at December 31, 2006,

discussed in detail in the proceeding table. The effect of a variation in a particular assumption on the fair

value of the Retained Interest is calculated without changing any other assumption. In reality, changes in one

factor may result in changes in another (for example, increases in market interest rates may result in lower

prepayments and increased credit losses), which might magnify or counteract the sensitivities. These

sensitivities are hypothetical, as the actual results could be materially different than these estimates.

FFELP Stafford and

Other Student

Loan Trusts

(5)

FFELP

Consolidation

Loan Trusts

(5)

Private Education

Loan Trusts

(5)

Year Ended December 31, 2006

(Dollars in millions)

Fair value of Residual Interest (millions) . . . .................. $701 $676

(1)

$1,965

Weighted-average life (in years) ........................... 2.9 7.3 7.2

Prepayment speed assumptions

(2)

.........................

Interim status ..................................... 0% N/A 0%

Repayment status .................................. 0-43% 3-9% 4-7%

Life of loan — repayment status ........................ 24% 6% 6%

Impact on fair value of 5% absolute increase ................. $ (56) $(113) $ (276)

Impact on fair value of 10% absolute increase . . . ............. $(101) $(188) $ (482)

Expected credit losses (as a% of student loan principal) ......... .06% .07% 4.36%

(3)

Impact on fair value of 5% absolute increase in default rate ....... $ (12) $ (10) $ (268)

Impact on fair value of 10% absolute increase in default rate ....... $ (25) $ (20) $ (535)

Residual cash flows discount rate ......................... 12.6% 10.5% 12.6%

Impact on fair value of 5% absolute increase ................. $ (53) $(123) $ (353)

Impact on fair value of 10% absolute increase . . . ............. $ (99) $(213) $ (610)

Difference between Asset and Funding underlying indices

(4)

3 month LIBOR forward curve at

December 31, 2006 plus contracted spreads

Impact on fair value of 0.25% absolute increase in funding

index compared to asset index . . ....................... $(102) $(201) $ (6)

Impact on fair value of 0.50% absolute increase in funding index

compared to asset index . ............................ $(203) $(400) $ (13)

(1)

Certain consolidation trusts have $3.4 billion of non-U.S. dollar (Euro denominated) bonds outstanding. To convert these non-U.S. dol-

lar denominated bonds into U.S. dollar liabilities, the trusts have entered into foreign-currency swaps with highly-rated counterparties.

These swaps are in a $502 million gain position (in the aggregate) and $398 million position net of collateral posted as a result of the

decline in the exchange rates between the U.S. dollar and the Euro. This unrealized market value gain is not part of the fair value of

the Residual Interest in the table above. Not all derivatives within the trusts require the swap counterparties to post collateral to the

respective trust for changes in market value, unless the trust’s swap counterparty’s credit rating has been withdrawn or has been down-

graded below a certain level. If the swap counterparty does not post the required collateral or is downgraded further, the counterparty

must find a suitable replacement counterparty or provide the trust with a letter of credit or a guaranty from an entity that has the

required credit ratings. Ultimately, the Company’s exposure related to a swap counterparty failing to make its payments is limited to

the fair value of the related trust’s Residual Interest which was $349 million as of December 31, 2006.

(2)

See previous table for details on CPR. Impact on fair value due to increase in prepayment speeds only increases the repayment status

speeds. Interim status CPR remains 0%.

(3)

Expected credit losses are used to project future cash flows related to the Private Education Loan securitization’s Residual Interest.

However, for all trusts settling prior to September 30, 2005, the Company, to date, has purchased loans at par when the loans reach

180 days delinquent prior to default under a contingent call option, resulting in no credit losses at the trust nor related to the Compa-

ny’s Residual Interest. When the Company exercises its contingent call option and purchases the loan from the trust at par, the Com-

pany records a loss related to these loans that are now on the Company’s balance sheet. The Company recorded losses of $48 million,

$32 million, and $27 million for the years ended December 31, 2006, 2005 and 2004, respectively, related to this activity. For all trusts

settling after October 1, 2005 the Company does not hold this contingent call option. Credit losses, net of recoveries, for these trusts

where the Company does not hold the contingent call option, were $2.1 million, and $0.2 million for the years ended December 31,

2006 and 2005, respectively.

(4)

Student loan assets are primarily indexed to a Treasury bill, commercial paper or a prime index. Funding within the trust is primarily

indexed to a LIBOR index. Sensitivity analysis increases funding indexes as indicated while keeping asset underlying indexes fixed.

F-43

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)