Sallie Mae 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. Significant Accounting Policies (Continued)

method. Generally, the approach in SFAS No. 123(R) is similar to the approach described in SFAS No. 123.

However, SFAS No. 123(R) requires all share-based payments to employees, including grants of employee

stock options, to be recognized in the income statement based on their fair values. Prior to January 1, 2006,

the Company accounted for its stock option plans using the intrinsic value method of accounting provided

under Accounting Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related interpretations, and therefore no related compensation expense was recorded for awards granted

with no intrinsic value. Accordingly, for periods prior to January 1, 2006, share-based compensation was

included as a pro forma disclosure in the financial statement footnotes.

Using the modified prospective transition method of SFAS No. 123(R), the Company’s compensation cost

in the year ended December 31, 2006 includes: 1) compensation cost related to the remaining unvested portion

of all share-based payments granted prior to January 1, 2006, based on the grant date fair value estimated in

accordance with the original provisions of SFAS No. 123; and 2) compensation cost for all share-based

payments granted subsequent to January 1, 2006, based on the grant date fair value estimated in accordance

with the provisions of SFAS No. 123(R). Results for prior periods have not been restated.

As a result of adopting SFAS No. 123(R), the Company’s earnings before income taxes for the year ended

December 31, 2006 were $62 million lower than if it had continued to account for stock-based compensation

under APB No. 25, and net earnings were $39 million ($.09 per diluted share) lower.

SFAS No. 123(R) requires that the excess (i.e., windfall) tax benefits from tax deductions on the exercise

of share-based payments exceeding the deferred tax assets from the cumulative compensation cost previously

recognized be classified as cash inflows from financing activities in the consolidated statement of cash flows.

Prior to the adoption of SFAS No. 123(R), the Company presented all excess tax benefits resulting from the

exercise of share-based payments as operating cash flows. The excess tax benefit for the year ended

December 31, 2006 was $33 million.

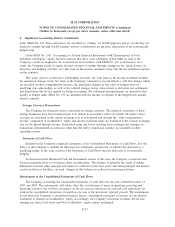

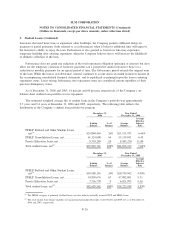

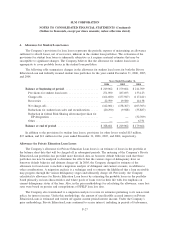

The following table provides pro forma net income and earnings per share had the Company applied the

fair value method of SFAS No. 123(R) for the years ended December 31, 2005 and 2004.

2005 2004

Years Ended December 31,

Net income attributable to common stock ........................ $1,360,381 $1,901,769

Add: Total stock-based compensation expense included in net income,

netoftax.............................................. 12,343 11,871

Less: Total stock-based compensation expense determined under fair

value based method for all awards, net of tax ................... (51,842) (53,756)

Pro forma net income attributable to common stock ................ $1,320,882 $1,859,884

Reported basic earnings per common share ....................... $ 3.25 $ 4.36

Pro forma basic earnings per common share ...................... $ 3.16 $ 4.26

Reported diluted earnings per common share ..................... $ 3.05 $ 4.04

Pro forma diluted earnings per common share..................... $ 2.97 $ 3.96

Income Taxes

Income taxes are recorded in accordance with SFAS No. 109, “Accounting for Income Taxes.” The asset

and liability approach underlying SFAS No. 109 requires the recognition of deferred tax liabilities and assets

F-20

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)