Sallie Mae 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

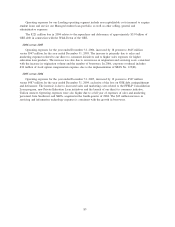

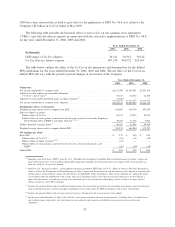

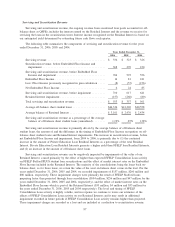

settlement in the College Loan Corporation (“CLC”) lawsuit and to lower corporate information technology

expenses.

At December 31, 2006, 2005 and 2004, the Corporate and Other operating segment had total assets of

$999 million, $719 million and $524 million, respectively.

LIQUIDITY AND CAPITAL RESOURCES

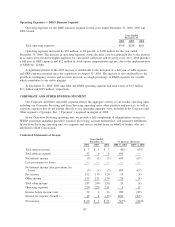

Except in the case of acquisitions, which are discussed separately, our DMO and Corporate and Other

business segments are not capital intensive businesses and as such a minimal amount of debt and equity capital

is allocated to these segments. Therefore, the following “LIQUIDITY AND CAPITAL RESOURCES”

discussion is concentrated on our Lending business segment.

We have developed deep and diverse funding sources to ensure continued access to funding to support

our business plan. Our biggest funding challenge continues to be our ability to maintain cost-effective liquidity

to fund the growth in the Managed portfolio of student loans as well as to refinance previously securitized

loans when borrowers choose to refinance their loans through a FFELP Consolidation Loan or a Private

Education Consolidation Loan with us. At the same time, we maintain earnings spreads by controlling interest

rate risk. Our main source of funding is student loan securitizations and we have built a highly liquid and deep

market for such financings as evidenced by the $32.1 billion in student loans securitized in thirteen

transactions in 2006, and $26.1 billion in twelve transactions in 2005. We are the largest issuer in the student

loan asset-backed sector. FFELP securitizations are unique securities in the asset-backed market as they are

backed by student loans with an explicit U.S. government guarantee on 99 percent of principal and interest

(prior to July 1, the guarantee was 100 percent). The investor base for our student loan-backed securities is

worldwide and we believe that the market for these securities will be available to meet our long-term funding

needs for the foreseeable future. Securitizations comprised 69 percent of our Managed debt outstanding at

December 31, 2006, unchanged from December 31, 2005.

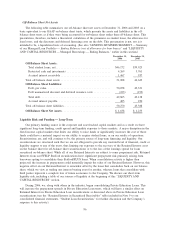

In addition to securitizations, we also continued to diversify our sources of funding and issued

$11.7 billion in SLM Corporation long-term, unsecured debt in 2006. Over the years we have strategically

introduced several SLM Corporation long-term debt structures that further diversified our funding sources and

substantially increased our fixed income investor base. In total, at December 31, 2006, on-balance sheet debt,

exclusive of on-balance sheet securitizations and secured indentured trusts, totaled $48.9 billion versus

$41.7 billion at December 31, 2005.

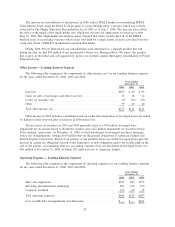

Liquidity at SLM Corporation is important to enable us to effectively fund our student loan acquisitions,

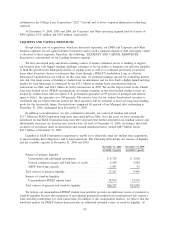

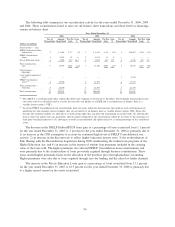

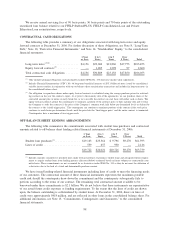

to meet maturing debt obligations, and to fund operations. The following table details our sources of liquidity

and the available capacity at December 31, 2006 and 2005.

Available Capacity Available Capacity

December 31, 2006 December 31, 2005

Sources of primary liquidity:

Unrestricted cash and liquid investments ............... $ 4,720 $ 3,928

Unused commercial paper and bank lines of credit ........ 6,500 5,500

ABCP borrowing capacity . . . ....................... 1,047 41

Total sources of primary liquidity ...................... 12,267 9,469

Sources of stand-by liquidity:

Unencumbered FFELP student loans .................. 28,070 24,530

Total sources of primary and stand-by liquidity ............ $40,337 $33,999

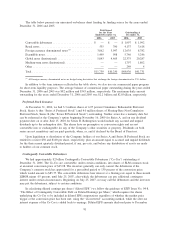

We believe our unencumbered FFELP student loan portfolio provides an additional source of potential or

stand-by liquidity because the maturation of government guaranteed student loan securitizations has created a

wide and deep marketplace for such transactions. In addition to the securitization markets, we believe that the

wholesale market for FFELP student loans provides an additional potential source of stand-by liquidity. At

89