Sallie Mae 2006 Annual Report Download - page 141

Download and view the complete annual report

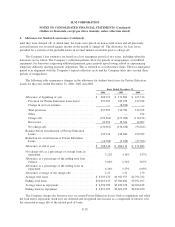

Please find page 141 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans — an amendment of FASB Statements Nos. 87, 88, 106 and 132(R).”

SFAS No. 158 requires an employer that sponsors one or more single-employer defined benefit plans to

(a) recognize the overfunded or underfunded status of a benefit plan in its statement of financial position,

(b) recognize as a component of other comprehensive income, net of tax, the gains or losses and prior service

costs or credits that arise during the period but are not recognized as components of net periodic benefit cost

pursuant to SFAS No. 87, “Employers’ Accounting for Pensions,” or SFAS No. 106, “Employers’ Accounting

for Postretirement Benefits Other Than Pensions,” (c) measure defined benefit plan assets and obligations as of

the date of the employer’s fiscal year-end, and (d) disclose in the notes to financial statements additional

information about certain effects on net periodic benefit cost for the next fiscal year that arise from delayed

recognition of the gains or losses, prior service costs or credits, and transition asset or obligation. SFAS No. 158

is effective for the Company’s fiscal year ending December 31, 2006. The adoption of SFAS No. 158 resulted

in an adjustment to accumulated other comprehensive income of a $19 million gain, net of tax.

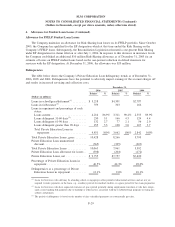

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” This statement is

effective for financial statements issued for fiscal years beginning after November 15, 2007. This statement

defines fair value, establishes a framework for measuring fair value within GAAP, and expands disclosures

about fair value measurements. This statement applies to other accounting pronouncements that require or

permit fair value measurements. Accordingly, this statement does not change which types of instruments are

carried at fair value, but rather establishes the framework for measuring fair value. The Company is currently

evaluating the potential impact of SFAS No. 157 on its financial statements.

Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year

Financial Statements

In September 2006, the Securities and Exchange Commission (the “SEC”) issued Staff Accounting

Bulletin (“SAB”) No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstate-

ments in Current Year Financial Statements.” SAB No. 108 eliminates the diversity of practice surrounding

how public companies quantify financial statement misstatements. It establishes an approach that requires

quantification of financial statement misstatements based on the effects of the misstatements on each of a

company’s financial statements and the related financial statement disclosures. SAB No. 108 is effective for

fiscal years ending on or after November 15, 2006, with earlier adoption encouraged. The adoption of

SAB No. 108 did not have an impact on its financial statements.

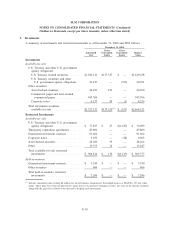

Accounting for Uncertainty in Income Taxes

In July 2006, the FASB issued FIN No. 48, “Accounting for Uncertainty in Income Taxes,” which amends

SFAS No. 109, “Accounting for Income Taxes.” This statement will be effective for the Company beginning

January 1, 2007.

This interpretation:

• Changes historical methods of recording the impact to the financial statements of uncertain tax

positions from a model based upon probable liabilities to be owed, to a model based upon the tax

benefit most likely to be sustained.

F-22

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)