Sallie Mae 2006 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

were received before November 13, 1997, the weighted average interest rate is rounded up to the nearest

whole percent. FFELP Consolidation Loans made on or after July 1, 1994 for which applications were

received on or after November 13, 1997 through September 30, 1998 bear interest at the annual variable rate

applicable to Stafford Loans subject to a cap of 8.25 percent. FFELP Consolidation Loans for which the

application is received on or after October 1, 1998 bear interest at a fixed rate equal to the weighted average

interest rate of the loans being consolidated rounded up to the nearest one-eighth of one percent, subject to a

cap of 8.25 percent.

Interest on FFELP Consolidation Loans accrues and, for applications received before January 1, 1993, is

paid without interest subsidy by the Department. For FFELP Consolidation Loans for which applications were

received between January 1 and August 10, 1993, all interest of the borrower is paid during deferral periods.

FFELP Consolidation Loans for which applications were received on or after August 10, 1993 are only

subsidized if all of the underlying loans being consolidated were Subsidized Stafford Loans. In the case of

FFELP Consolidation Loans made on or after November 13, 1997, the portion of a Consolidation Loan that is

comprised of Subsidized FFELP Loans and Subsidized FDLP Loans retains subsidy benefits during deferral

periods.

No insurance premium is charged to a borrower or a lender in connection with a Consolidation Loan.

However, lenders must pay a monthly rebate fee to the Department at an annualized rate of 1.05 percent on

principal and interest on FFELP Consolidation Loans for loans disbursed on or after October 1, 1993, and at

an annualized rate of 0.62 percent for Consolidation Loan applications received between October 1, 1998 and

January 31, 1999. The rate for special allowance payments for FFELP Consolidation Loans is determined in

the same manner as for other FFELP loans.

A borrower must begin to repay his Consolidation Loan within 60 days after his consolidated loans have

been discharged. For applications received on or after January 1, 1993, repayment schedule options include

graduated, income-sensitive, and extended (for new borrowers on or after October 7, 1998) repayment plans,

and loans are repaid over periods determined by the sum of the Consolidation Loan and the amount of the

borrower’s other eligible student loans outstanding. The maximum maturity schedule is 30 years for

indebtedness of $60,000 or more.

Guarantee Agencies under the FFELP

Under the FFELP, guarantee agencies guarantee (or insure) loans made by eligible lending institutions.

Student loans are guaranteed as to 100 percent of principal and accrued interest against death or discharge.

Guarantee agencies also guarantee lenders against default. For loans that were made before October 1, 1993,

lenders are insured for 100 percent of the principal and unpaid accrued interest. From October 1, 1993 to

June 30, 2006, lenders are insured for 98 percent of principal and all unpaid accrued interest or 100 percent of

principal and all unpaid accrued interest if it receives an Exceptional Performance designation by the

Department of Education. Insurance for loans made on or after July 1, 2006 is reduced from 98 percent to

97 percent, and insurance for claim requests on or after July 1, 2006 under an Exceptional Performance

designation is reduced from 100 percent to 99 percent.

The Department of Education reinsures guarantors for amounts paid to lenders on loans that are

discharged or defaulted. The reimbursement on discharged loans is for 100 percent of the amount paid to the

holder. The reimbursement rate for defaulted loans decreases as a guarantor’s default rate increases. The first

trigger for a lower reinsurance rate is when the amount of defaulted loan reimbursements exceeds 5 percent of

the amount of all loans guaranteed by the agency in repayment status at the beginning of the federal fiscal

year. The second trigger is when the amount of defaults exceeds 9 percent of the loans in repayment.

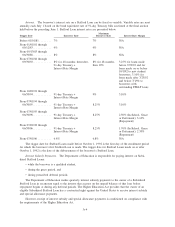

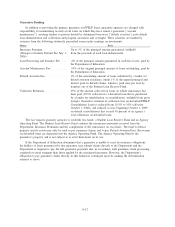

Guarantee agency reinsurance rates are presented in the table below.

Claims Paid Date Maximum 5% Trigger 9% Trigger

Before October 1, 1993 .............................. 100% 90% 80%

October 1, 1993 - September 30, 1998 ................... 98% 88% 78%

On or after October 1, 1998 .......................... 95% 85% 75%

A-10