Sallie Mae 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

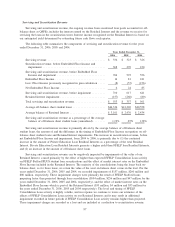

December 31, 2006, we had $365 million of investments on our balance sheet that were pledged as collateral

related to certain derivative positions and $99 million of other non-liquid investments, neither of which were

included in the above table.

In addition to liquidity, a major objective when financing our business is to minimize interest rate risk by

matching the interest rate and reset characteristics of our Managed assets and liabilities, generally on a pooled

basis, to the extent practicable. In this process we use derivative financial instruments extensively to reduce

our interest rate and foreign currency exposure. This interest rate risk management helps us to stabilize our

student loan spread in various and changing interest rate environments. (See also “RISKS — Interest Rate Risk

Management” below.)

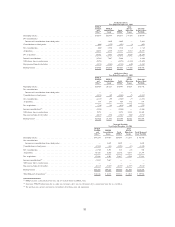

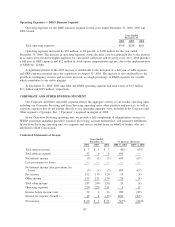

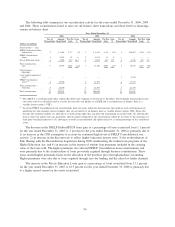

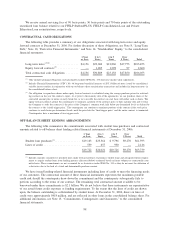

The following tables present the ending and average balances and average interest rates of our Managed

borrowings for the years ended December 31, 2006, 2005 and 2004. The average interest rates include

derivatives that are economically hedging the underlying debt but do not qualify for hedge accounting

treatment under SFAS No. 133. (See “BUSINESS SEGMENTS — Limitations of ‘Core Earnings’ — Deriva-

tive Accounting — Reclassification of Realized Gains (Losses) on Derivative and Hedging Activities.”)

Short

Term

Long

Term

Total

Managed

Basis

Short

Term

Long

Term

Total

Managed

Basis

Short

Term

Long

Term

Total

Managed

Basis

Ending Balance Ending Balance Ending Balance

2006 2005 2004

Years Ended December 31,

Unsecured borrowings . ............ $3,435 $ 45,501 $ 48,936 $3,787 $ 37,944 $ 41,731 $1,830 $ 31,465 $ 33,295

Indentured trusts (on-balance sheet) . . . . 93 2,852 2,945 23 3,372 3,395 377 6,873 7,250

Securitizations (on-balance sheet) ...... — 55,100 55,100 — 47,235 47,235 — 35,769 35,769

Securitizations (off-balance sheet) . . . . . — 49,865 49,865 — 43,138 43,138 — 43,814 43,814

Total . . ...................... $3,528 $153,318 $156,846 $3,810 $131,689 $135,499 $2,207 $117,921 $120,128

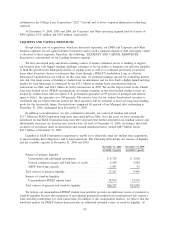

Average

Balance

Average

Rate

Average

Balance

Average

Rate

Average

Balance

Average

Rate

2006 2005 2004

Years Ended December 31,

GSE borrowings (unsecured) . . ........................ $ — —% $ — —% $ 9,967 2.21%

Unsecured borrowings . ............................. 43,927 5.50 37,980 3.98 28,241 2.29

Indentured trusts (on-balance sheet) . . . ................... 3,252 4.57 4,782 3.27 2,168 2.47

Securitizations (on-balance sheet) ....................... 48,184 5.39 39,713 3.72 28,354 1.79

Securitizations (off-balance sheet) ....................... 50,112 5.49 44,545 3.77 42,606 2.09

Total . . . ....................................... $145,475 5.44% $127,020 3.80% $111,336 2.08%

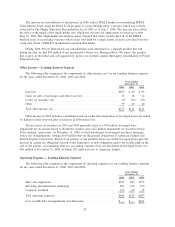

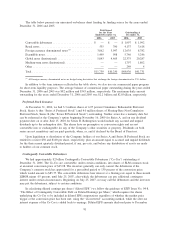

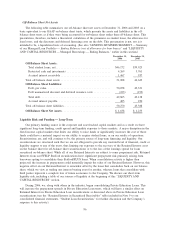

Unsecured On-Balance Sheet Financing Activities

The following table presents the senior unsecured credit ratings on our debt from major rating agencies as

of December 31, 2006.

S&P Moody’s Fitch

Short-term unsecured debt ..................................... A-1 P-1 F1+

Long-term unsecured debt ..................................... A A2 A+

90