Sallie Mae 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

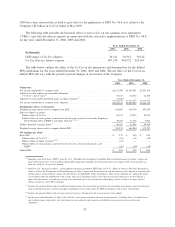

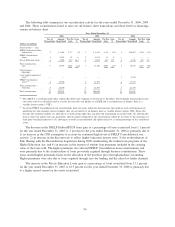

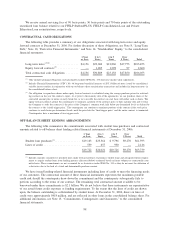

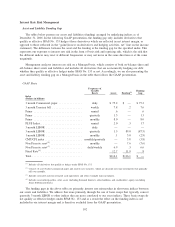

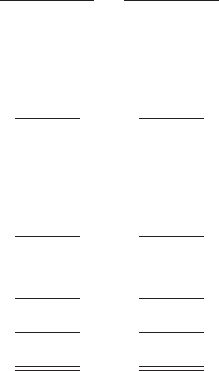

Off-Balance Sheet Net Assets

The following table summarizes our off-balance sheet net assets at December 31, 2006 and 2005 on a

basis equivalent to our GAAP on-balance sheet trusts, which presents the assets and liabilities in the off-

balance sheet trusts as if they were being accounted for on-balance sheet rather than off-balance sheet. This

presentation, therefore, includes a theoretical calculation of the premiums on student loans, the allowance for

loan losses, and the discounts and deferred financing costs on the debt. This presentation is not, nor is it

intended to be, a liquidation basis of accounting. (See also “LENDING BUSINESS SEGMENT — Summary

of our Managed Loan Portfolio — Ending Balances (net of allowance for loan losses)” and “LIQUIDITY

AND CAPITAL RESOURCES — Managed Borrowings — Ending Balances,” earlier in this section.)

December 31,

2006

December 31,

2005

Off-Balance Sheet Assets:

Total student loans, net ................................... $46,172 $39,925

Restricted cash and investments ............................ 4,269 3,761

Accrued interest receivable ................................ 1,467 937

Total off-balance sheet assets ................................ 51,908 44,623

Off-Balance Sheet Liabilities:

Debt, par value ......................................... 50,058 43,331

Debt unamortized discount and deferred issuance costs ........... (193) (193)

Total debt............................................. 49,865 43,138

Accrued interest payable .................................. 405 250

Total off-balance sheet liabilities.............................. 50,270 43,388

Off-Balance Sheet Net Assets ............................... $ 1,638 $ 1,235

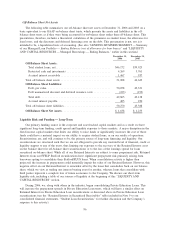

Liquidity Risk and Funding — Long-Term

Our primary funding source is the corporate and asset-backed capital markets and as a result we have

significant long-term funding, credit spread and liquidity exposure to those markets. A major disruption in the

fixed income capital markets that limits our ability to raise funds or significantly increases the cost of those

funds could have a material impact on our ability to acquire student loans, or on our results of operations.

Securitizations are, and will continue to be, the primary source of long-term financing and liquidity. Our

securitizations are structured such that we are not obligated to provide any material level of financial, credit or

liquidity support to any of the trusts, thus limiting our exposure to the recovery of the Retained Interest asset

on the balance sheet for off-balance sheet securitizations or to the loss of the earnings spread for loans

securitized on-balance sheet. While all of our Retained Interests are subject to some prepayment risk, Retained

Interests from our FFELP Stafford securitizations have significant prepayment risk primarily arising from

borrowers opting to consolidate their Stafford/PLUS loans. When consolidation activity is higher than

projected, the increase in prepayment could materially impair the value of our Retained Interest. However, this

negative effect on our Retained Interest is somewhat offset by the loans that consolidate back on our balance

sheet, which we view as trading one interest bearing asset for another, whereas loans that consolidate with

third parties represent a complete loss of future economics to the Company. We discuss our short-term

liquidity risk, including a table of our sources of liquidity at the beginning of this “LIQUIDITY AND

CAPITAL RESOURCES” section.

During 2006, we, along with others in the industry, began consolidating Private Education Loans. This

will increase the prepayment spreads in Private Education Loan trusts, which will have a similar effect on

Retained Interests in Private Education Loan securitizations as discussed above in Private Education Loan

securitizations (see the “Retained Interest in Securitized Receivables” table included in Note 9 to our

consolidated financial statements, “Student Loan Securitization,” for further discussion and the Company’s

response to this activity).

96