Sallie Mae 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

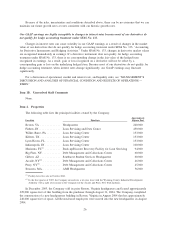

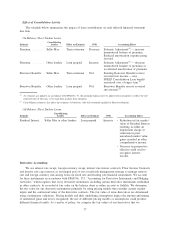

The following table lists the principal facilities leased by the Company as of December 31, 2006:

Location Function

Approximate

Square Feet

Niles, IL ............. AFSHeadquarters 84,000

Summerlin, Nevada ..... Debt Management and Collections Center 71,000

Cincinnati, Ohio ....... GRCHeadquarters and Debt Management and Collections

Center

59,000

Muncie, IN ........... SLM— DMO 54,000

Needham, MA ........ Upromise 49,000

Mt. Laurel, New Jersey . . SLM Financial Headquarters and Operations 42,000

Novi, MI ............ Sallie Mae Home Loans 37,000

Seattle, WA .......... NELA 32,000

Moorestown, NJ ....... Pioneer Credit Recovery 30,000

Braintree, MA......... Nellie Mae Headquarters 27,000

Whitewater, WI ....... AFSOperations 16,000

Centennial, CO ........ Noel-Levitz 16,000

White Plains, NY ...... GRP 15,400

West Valley, NY ....... Pioneer Credit Recovery 14,000

Batavia, NY .......... Pioneer Credit Recovery 13,000

Iowa City, IA ......... Noel-Levitz 13,000

Perry, NY ............ Pioneer Credit Recovery 12,000

Gainesville, FL ........ SLMLSC 11,000

Phoenix, AZ .......... Sallie Mae Home Loans 9,000

Cincinnati, OH ........ Student Loan Funding 9,000

Burlington, MA ....... Sallie Mae Home Loans 8,000

Washington, D.C. ...... Government Relations 5,000

None of the Company’s facilities is encumbered by a mortgage. The Company believes that its

headquarters, loan servicing centers data center, back-up facility and data management and collections centers

are generally adequate to meet its long-term student loan and new business goals. The Company’s principal

office is currently in owned space at 12061 Bluemont Way, Reston, Virginia, 20190.

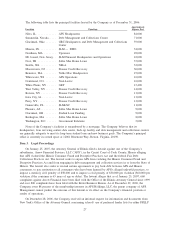

Item 3. Legal Proceedings

On January 25, 2007, the Attorney General of Illinois filed a lawsuit against one of the Company’s

subsidiaries, Arrow Financial Services, LLC (“AFS”), in the Circuit Court of Cook County, Illinois alleging

that AFS violated the Illinois Consumer Fraud and Deceptive Practices Act and the federal Fair Debt

Collections Practices Act. The lawsuit seeks to enjoin AFS from violating the Illinois Consumer Fraud and

Deceptive Practices Act and from engaging in debt management and collection services in or from the State of

Illinois. The lawsuit also seeks to rescind certain agreements to pay back debt between AFS and Illinois

consumers, to pay restitution to all consumers who have been harmed by AFS’s alleged unlawful practices, to

impose a statutory civil penalty of $50,000 and to impose a civil penalty of $50,000 per violation ($60,000 per

violation if the consumer is 65 years of age or older). The lawsuit alleges that as of January 25, 2007, 660

complaints against Arrow Financial have been filed with the Office of the Illinois Attorney General since 1999

and over 800 complaints have been filed with the Better Business Bureau. As of December 29, 2006, the

Company owns 88 percent of the membership interests in AFS Holdings, LLC, the parent company of AFS.

Management cannot predict the outcome of this lawsuit or its effect on the Company’s financial position or

results of operations.

On December 28, 2006, the Company received an informal request for information and documents from

New York’s Office of the Attorney General concerning schools’ use of preferred lender lists for either FFELP

27