Sallie Mae 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

currency exchange rate volatility, changing credit spreads and changes in our stock price during the period as

well as the volume and term of derivatives not receiving hedge treatment.

Our Floor Income Contracts are written options that must meet more stringent requirements than other

hedging relationships to achieve hedge effectiveness under SFAS No. 133. Specifically, our Floor Income

Contracts do not qualify for hedge accounting treatment because the paydown of principal of the student loans

underlying the Floor Income embedded in those student loans does not exactly match the change in the

notional amount of our written Floor Income Contracts. Under SFAS No. 133, the upfront payment is deemed

a liability and changes in fair value are recorded through income throughout the life of the contract. The

change in the value of Floor Income Contracts is primarily caused by changing interest rates that cause the

amount of Floor Income earned on the underlying student loans and paid to the counterparties to vary. This is

economically offset by the change in value of the student loan portfolio, including our Retained Interests,

earning Floor Income but that offsetting change in value is not recognized under SFAS No. 133. We believe

the Floor Income Contracts are economic hedges because they effectively fix the amount of Floor Income

earned over the contract period, thus eliminating the timing and uncertainty that changes in interest rates can

have on Floor Income for that period. Prior to SFAS No. 133, we accounted for Floor Income Contracts as

hedges and amortized the upfront cash compensation ratably over the lives of the contracts.

Basis swaps are used to convert floating rate debt from one floating interest rate index to another to better

match the interest rate characteristics of the assets financed by that debt. We primarily use basis swaps to

change the index of our floating rate debt to better match the cash flows of our student loan assets that are

primarily indexed to a commercial paper, Prime or Treasury bill index. In addition, we use basis swaps to

convert debt indexed to the Consumer Price Index to 3 month LIBOR debt. SFAS No. 133 requires that when

using basis swaps, the change in the cash flows of the hedge effectively offset both the change in the cash

flows of the asset and the change in the cash flows of the liability. Our basis swaps hedge variable interest rate

risk, however they generally do not meet this effectiveness test because most of our FFELP student loans can

earn at either a variable or a fixed interest rate depending on market interest rates. We also have basis swaps

that do not meet the SFAS No. 133 effectiveness test that economically hedge off-balance sheet instruments.

As a result, under GAAP these swaps are recorded at fair value with changes in fair value reflected currently

in the income statement.

Under SFAS No. 150, equity forward contracts that allow a net settlement option either in cash or the

Company’s stock are required to be accounted for as derivatives in accordance with SFAS No. 133. As a

result, we account for our equity forward contracts as derivatives in accordance with SFAS No. 133 and mark

them to market through earnings. They do not qualify as effective SFAS No. 133 hedges, as a requirement to

achieve hedge accounting is the hedged item must impact net income and the settlement of these contracts

through the purchase of our own stock does not impact net income.

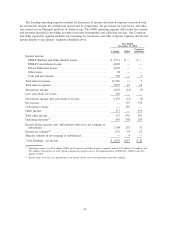

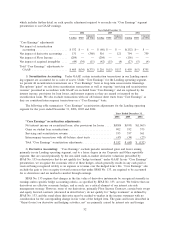

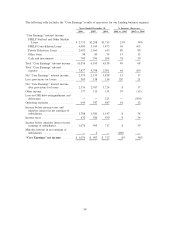

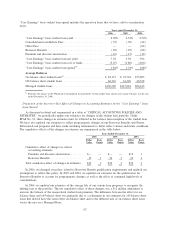

The table below quantifies the adjustments for derivative accounting under SFAS No. 133 on our net

income for the years ended December 31, 2006, 2005 and 2004, when compared with the accounting

principles employed in all years prior to the SFAS No. 133 implementation.

2006 2005 2004

Years Ended December 31,

“Core Earnings” derivative adjustments:

Gains (losses) on derivative and hedging activities, net, included in other

income

(1)

............................................... $(339) $247 $ 849

Less: Realized losses on derivative and hedging activities, net

(1)

........ 109 387 713

Unrealized gains (losses) on derivative and hedging activities, net ....... (230) 634 1,562

Other pre-SFAS No. 133 accounting adjustments ................... 1 3 (9)

Total net impact of SFAS No. 133 derivative accounting.............. $(229) $637 $1,553

(1)

See “Reclassification of Realized Gains (Losses) on Derivative and Hedging Activities” below for a detailed breakdown of the

components of realized losses on derivative and hedging activities.

53