Sallie Mae 2006 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

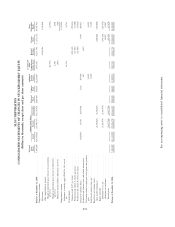

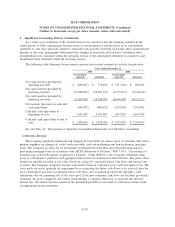

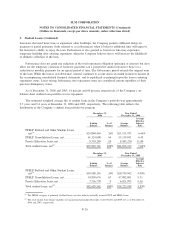

2. Significant Accounting Policies (Continued)

As a result of an evaluation of the classification of our cash flows that the Company initiated in the

fourth quarter of 2006, management became aware of several incorrect classifications in its consolidated

statement of cash flows primarily related to restricted cash accounts involving on-balance sheet securitizations.

Specific to this item, management determined that changes in restricted cash related to on-balance sheet

securitizations were classified within the operating section of the consolidated statement of cash flows and

should have been classified within the investing section.

The following table illustrates the previously reported and restated amounts by activity classification.

As previously

reported Restated

As previously

reported Restated

2005 2004

Years Ended December 31,

Net cash (used in) provided by

operating activities ............ $ (698,827) $ 758,830 $ (317,216) $ 604,825

Net cash (used in) provided by

investing activities ............ (15,668,823) (16,903,732) (8,775,271) (9,612,146)

Net cash (used in) provided by

financing activities ............ 15,470,818 15,248,070 10,640,389 10,555,223

Net increase (decrease) in cash and

cash equivalents .............. (896,832) (896,832) 1,547,902 1,547,902

Cash and cash equivalents at

beginning of year ............. 3,395,487 3,395,487 1,847,585 1,847,585

Cash and cash equivalents at end of

year ....................... $ 2,498,655 $ 2,498,655 $ 3,395,487 $ 3,395,487

See also Note 21, “Restatement of Quarterly Consolidated Statements of Cash Flows (unaudited).”

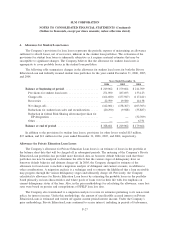

Collections Revenue

The Company purchases delinquent and charged-off receivables on various types of consumer debt with a

primary emphasis on charged-off credit card receivables, and sub-performing and non-performing mortgage

loans. The Company accounts for its investments in charged-off receivables and sub-performing and non-

performing mortgage loans in accordance with AICPA Statement of Position (“SOP”) 03-3, “Accounting for

Certain Loans or Debt Securities Acquired in a Transfer.” Under SOP 03-3, the Company establishes static

pools of each quarter’s purchases and aggregates them based on common risk characteristics. The pools when

formed are initially recorded at fair value, based on each pool’s estimated future cash flows and internal rate

of return. The Company recognizes income each month based on each static pool’s effective interest rate. The

static pools are tested quarterly for impairment by re-estimating the future cash flows to be received from the

pools. Subsequent increases in estimated future cash flows are recognized prospectively through a yield

adjustment over the remaining life of the static pool. If the new estimated cash flows are less than previously

estimated, the pool is impaired and written down through a valuation allowance, to maintain the effective

interest rate. Net interest income earned on the purchased portfolios is recorded as collection revenue on the

accompanying income statement.

F-18

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)