Sallie Mae 2006 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

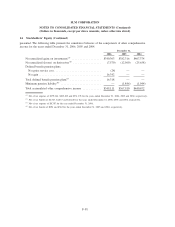

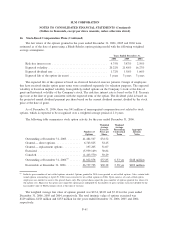

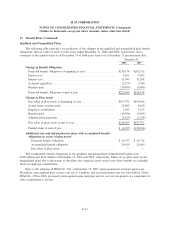

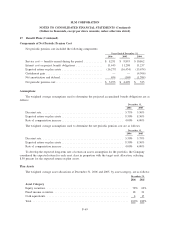

16. Stock-Based Compensation Plans (Continued)

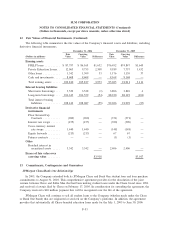

The following table summarizes RSU activity for the year ended December 31, 2006.

Number of

RSUs

Weighted

Average Grant

Date

Fair Value

Outstanding at December 31, 2005 ............................. 840,000 $34.81

Granted ................................................. 100,000 55.82

Canceled ................................................ — —

Converted to common stock .................................. (300,000) 31.93

Outstanding at December 31, 2006 ............................. 640,000 $39.45

Vested

(1)

................................................ 450,000 $33.91

(1)

450,000 RSUs vested in 2006 but will not be converted to common stock until the employee’s retirement or termination of

employment.

There were 34,946 dividend equivalents on outstanding RSUs at December 31, 2006.

The total fair value of RSUs that vested during the years ended December 31, 2006, 2005 and 2004 was

$15 million, $10 million and $0 million, respectively. The total intrinsic value of RSUs converted to common

stock during the year ended December 31, 2006 was $10 million. There were no RSUs converted to common

stock in the year-ago periods.

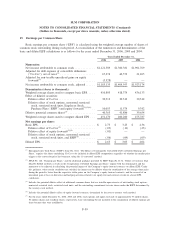

Employee Stock Purchase Plan

Employees may purchase shares of the Company’s common stock under the ESPP at the end of a

24-month period at a price equal to the share price at the beginning of the 24-month period, less 15 percent,

up to a maximum purchase price of $10,000 plus accrued interest. There are four ESPP offerings a year, one

per quarter, and the purchase price for each offering is determined at the beginning of the offering period. The

total number of shares which may be sold pursuant to the plan may not exceed 7.6 million shares, of which

1.2 million shares remained available at December 31, 2006.

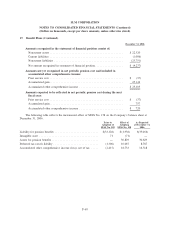

The fair values of the stock purchase rights of the ESPP offerings in the year ended December 31, 2006

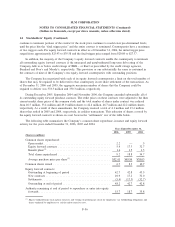

were calculated using a Black-Scholes option pricing model with the following weighted average assumptions.

Year Ended

December 31,

2006

Risk free interest rate ................................................. 4.75%

Expected volatility ................................................... 20.41%

Expected dividend rate ................................................ 1.92%

Expected life ....................................................... 2years

The expected volatility is based on implied volatility from publicly-traded options on the Company’s

stock at the date of grant and historical volatility of the Company’s stock. The risk-free interest rate is based

on the U.S. Treasury spot rate at the date of grant consistent with the expected term. The dividend yield is

based on the projected annual dividend payment per share based on the current dividend amount, divided by

the stock price at the date of grant.

F-63

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)