Sallie Mae 2006 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

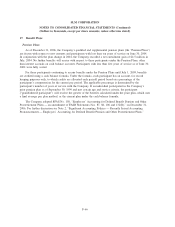

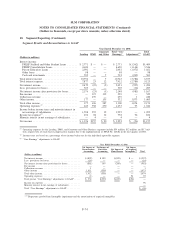

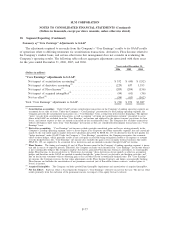

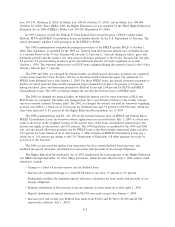

18. Segment Reporting (Continued)

Lending DMO

Corporate

and Other

Total ‘‘Core

Earnings” Adjustments

(2)

Total

GAAP

Year Ended December 31, 2004

(Dollars in millions)

Interest income:

FFELP Stafford and Other Student Loans . . $1,715 $ — $ — $1,715 $ (990) $ 725

FFELP Consolidation Loans ............ 1,473 — — 1,473 (108) 1,365

Private Education Loans ............... 613 — — 613 (277) 336

Other loans ........................ 74 — — 74 — 74

Cash and investments ................. 264 — 3 267 (34) 233

Total interest income ................... 4,139 — 3 4,142 (1,409) 2,733

Total interest expense ................... 2,301 13 6 2,320 (886) 1,434

Net interest income .................... 1,838 (13) (3) 1,822 (523) 1,299

Less: provisions for losses ............... 114 — — 114 (3) 111

Net interest income after provisions for

losses ............................. 1,724 (13) (3) 1,708 (520) 1,188

Fee income . . ........................ — 300 120 420 — 420

Collections revenue .................... — 39 — 39 — 39

Other income . ........................ 131 — 130 261 1,765 2,026

Total other income ..................... 131 339 250 720 1,765 2,485

Loss on GSE debt extinguishment ......... 221 — — 221 — 221

Operating expenses .................... 487 161 211 859 36 895

Income before income taxes and minority

interest in net earnings of subsidiaries ..... 1,147 165 36 1,348 1,209 2,557

Income tax expense

(1)

................... 430 65 (15) 480 162 642

Minority interest in net earnings of

subsidiaries ........................ — 1 — 1 — 1

Net income . . ........................ $ 717 $ 99 $ 51 $ 867 $1,047 $1,914

(1)

Income taxes are based on a percentage of net income (loss) before tax for the individual reportable segment.

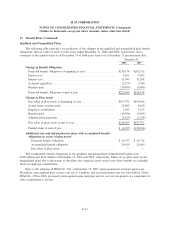

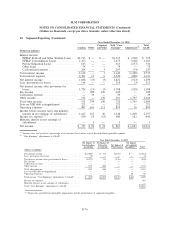

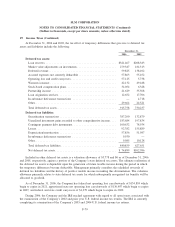

(2)

“Core Earnings” adjustments to GAAP:

Net Impact of

Securitization

Accounting

Net Impact of

Derivative

Accounting

Net Impact of

Floor Income

Net Impact

of Acquired

Intangibles

(A)

Total

Year Ended December 31, 2004

(Dollars in millions)

Net interest income . . . ....................... $(1,080) $ 713 $(156) $ — $ (523)

Less: provisions for losses ...................... (3) — — — (3)

Net interest income after provisions for losses . ........ (1,077) 713 (156) — (520)

Fee income . . . ............................ — — — — —

Collections revenue . . . ....................... — — — — —

Other income . . ............................ 925 840 — — 1,765

Total other income ........................... 925 840 — — 1,765

Loss on GSE debt extinguishment ................. — — — — —

Operating expenses . . . ....................... — — — 36 36

Total pre-tax “Core Earnings” adjustments to GAAP . . . . . $ (152) $1,553 $(156) $(36) 1,209

Income tax expense . . . ....................... 162

Minority interest in net earnings of subsidiaries ........ —

Total “Core Earnings” adjustments to GAAP . . . ....... $1,047

(A)

Represents goodwill and intangible impairment and the amortization of acquired intangibles.

F-76

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)