Sallie Mae 2006 Annual Report Download - page 42

Download and view the complete annual report

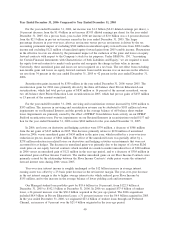

Please find page 42 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

For the year ended December 31, 2005, our net income decreased by 26 percent to $1.4 billion ($3.05

diluted earnings per share) from net income of $1.9 billion ($4.04 diluted earnings per share) in 2004. On a

pre-tax basis, income for the year ended December 31, 2005 decreased by 19 percent to $2.1 billion versus

$2.6 billion in the year ended December 31, 2004. The larger percentage decrease in net income versus pre-

tax income from 2004 to 2005 is primarily due to the increase in the effective tax rate from 25 percent in the

year ended 2004 to 34 percent in the year ended 2005. In the year ended 2005, we recognized unrealized

gains on our outstanding equity forward contracts of $121 million versus unrealized gains of $759 million in

the year ended 2004.

The decrease in pre-tax income is primarily due to a $602 million decrease in the gain on derivative and

hedging activities, which primarily relates to derivatives that do not receive hedge accounting treatment.

Unrealized derivative gains and losses are primarily driven by the effect of changes in the fair market value of

Floor Income Contracts and the effect of an increase in the value of our stock price on equity forward

contracts. The smaller unrealized gains on our Floor Income Contracts in 2005 were due to fewer contracts

being “in the money” to the counterparty due to spot interest rates, and to a smaller rise in forward interest

rates in 2005 versus 2004. Our stock price increased in both 2005 and 2004, but the absolute increase was less

in 2005 resulting in a smaller unrealized gain on our equity forward contracts in 2005.

The year-over-year decrease in servicing and securitization revenue was due primarily to impairments of

our Retained Interests in securitizations of $260 million in 2005 versus $80 million in 2004. These

impairments are largely driven by the continued rise in FFELP Consolidation Loan activity. The increase in

impairment losses was partially offset by an increase in securitization gains of $177 million primarily caused

by higher percentage gains on the two off-balance sheet Private Education Loan securitizations in 2005, versus

the two off-balance sheet Private Education Loan securitizations in 2004.

The year-over-year increase in debt management fees and collections revenue of $188 million is primarily

due to a full year impact of collections revenue from AFS, acquired in the third quarter of 2004, and overall

growth in the contingency fee businesses. Positive impacts to pre-tax income were offset by the year-over-year

increase in operating expenses of $243 million, primarily attributable to the expenses associated with three

subsidiaries acquired in the second half of 2004: AFS, Southwest Student Services Corporation (“Southwest”)

and Student Loan Finance Association (“SLFA”).

Net income for the year ended December 31, 2004 was also negatively impacted by a $221 million pre-

tax loss related to the repurchase and defeasance of $3.0 billion of GSE debt in connection with the GSE

Wind-Down in 2004.

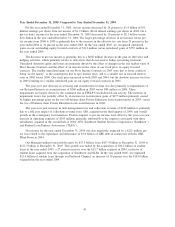

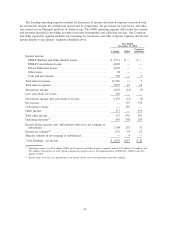

Our Managed student loan portfolio grew by $15.1 billion, from $107.4 billion at December 31, 2004 to

$122.5 billion at December 31, 2005. This growth was fueled by the acquisition of $30.2 billion of student

loans in the year ended 2005, a 27 percent increase over the $23.7 billion acquired in 2004, exclusive of

student loans acquired from the acquisition of Southwest and SLFA. In the year ended 2005, we originated

$21.4 billion of student loans through our Preferred Channel, an increase of 19 percent over the $18.0 billion

originated in the year ended 2004.

41