Sallie Mae 2006 Annual Report Download - page 112

Download and view the complete annual report

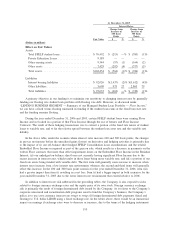

Please find page 112 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and hedged items matching. The balance sheet interest bearing liabilities would be affected by a change in

exchange rates, however, the change would be materially offset by the cross currency interest rate swaps in

other assets or other liabilities. In addition, the Company has foreign exchange risk as a result of international

operations, however, the exposure is minimal at this time.

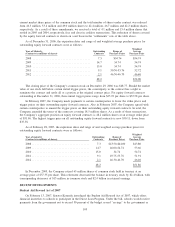

Equity price risk of the Company’s own stock is due to equity forward contracts used in the Company’s

share repurchase program. A hypothetical decrease in the Company’s stock price per share of $5.00 and

$10.00 would result in a $241 million and $482 million unrealized loss on derivative and hedging, respectively.

In addition to the net income impact, other liabilities would increase by the aforementioned amounts. Stock

price decreases can also result in the counterparty exercising its right to demand early settlement on a portion

of or the total contract depending on trigger prices set in each contract. The initial trigger prices as of

December 31, 2006 range from approximately $25.93 to $35.58. At December 29, 2006, the closing price of

the Company’s stock was $48.77. With the $5.00 and $10.00 decrease in unit stock price above, none of these

triggers would be met and no counterparty would have the right to early settlement.

Item 8. Financial Statements and Supplementary Data

Reference is made to the financial statements listed under the heading “(a) 1.A. Financial Statements” of

Item 15 hereof, which financial statements are incorporated by reference in response to this Item 8.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Nothing to report.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of December 31,

2006. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of

December 31, 2006, our disclosure controls and procedures were effective to ensure that information required

to be disclosed by us in the reports that we file or submit under the Exchange Act is (a) recorded, processed,

summarized and reported within the time periods specified in the SEC’s rules and forms and (b) accumulated

and communicated to our management, including our Chief Executive Officer and Chief Financial Officer as

appropriate to allow timely decisions regarding required disclosure.

As reported in a Current Report on Form 8-K filed by the Company on March 1, 2007, the Company has

included within this Annual Report on Form 10-K for the year ended December 31, 2006 restated consolidated

statements of cash flows for the annual periods of 2005 and 2004 and each of the quarterly periods of 2006

and 2005. The restatements do not affect the Company’s consolidated statements of income, consolidated

balance sheets or consolidated statements of changes in stockholders’ equity for any of the affected periods.

Accordingly, the Company’s historical revenues, net income, earnings per share, total assets and total

stockholders’ equity remain unchanged.

The restatements result from several incorrect classifications on the consolidated statements of cash flows,

primarily related to restricted cash accounts involving on-balance sheet securitizations. The cash flows from

these accounts had been classified as operating activities. However, in accordance with Statement of Financial

Accounting Standards (“SFAS”) No. 95, “Statement of Cash Flows,” cash flows from these accounts should

have been, and in the future will be, classified as investing activities, rather than operating activities.

Accordingly, the restatements will affect solely the classification and subtotals of cash flow activities, but they

will have no impact on the net increase (decrease) in total cash set forth in the consolidated statements of cash

flows for any of the previously reported periods. During the fourth quarter of 2006, management remediated

the control deficiency that resulted in the restatements by initiating a comprehensive evaluation of the

111