Sallie Mae 2006 Annual Report Download - page 140

Download and view the complete annual report

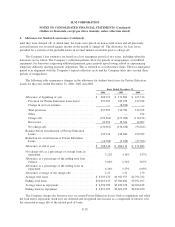

Please find page 140 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

for the expected future tax consequences of temporary differences between the carrying amounts and tax basis

of the Company’s assets and liabilities. To the extent tax laws change, deferred tax assets and liabilities are

adjusted in the period that the tax change is enacted.

“Income tax expense” includes (i) deferred tax expense, which represents the net change in the deferred

tax asset or liability balance during the year plus any change in a valuation allowance, and (ii) current tax

expense, which represents the amount of tax currently payable to or receivable from a tax authority plus

amounts accrued for expected tax deficiencies (including both tax, interest, and penalties). Income tax expense

excludes the tax effects related to adjustments recorded in equity.

In accordance with SFAS No. 5, “Accounting for Contingencies,” the Company records a reserve for

expected contingencies with the Internal Revenue Service and various state taxing authorities when it is

deemed that deficiencies arising from such contingencies are probable and reasonably estimable. This reserve

includes both tax and interest on these deficiencies.

Minority Interest in Subsidiaries

At December 31, 2006 and 2005, minority interest in subsidiaries represents interests held by minority

shareholders in AFS Holdings, LLC, of approximately 12 percent and 24 percent, respectively.

Earnings per Common Share

The Company computes earnings per common share (“EPS”) in accordance with SFAS No. 128,

“Earnings per Share.” See Note 15, “Earnings per Common Share,” for further discussion.

Reclassifications

Certain reclassifications have been made to the balances as of and for the years ended December 31,

2005 and 2004, to be consistent with classifications adopted for 2006.

Recently Issued Accounting Pronouncements

The Fair Value Option for Financial Assets and Financial Liabilities — Including an Amendment of

FASB Statement No. 115

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities — Including an Amendment of FASB Statement No. 115”. This statement permits entities

to choose to measure many financial instruments and certain other items at fair value (on an instrument by

instrument basis) improving financial reporting by providing entities with the opportunity to mitigate volatility

in reported earnings caused by measuring related assets and liabilities differently without having to apply

complex hedge accounting provisions. Most recognized financial assets and liabilities are eligible items for the

measurement option established by the statement. There are a few exceptions, including an investment in a

subsidiary or an interest in a variable interest entity that is required to be consolidated, certain obligations

related to post-employment benefits, assets or liabilities recognized under leases, various deposits and financial

instruments classified as shareholder’s equity. A business entity shall report unrealized gains and losses on

items for which the fair value option has been elected in earnings at each reporting date. The Company is

currently evaluating the impact of this standard on its financial statements. The statement will be effective

beginning January 1, 2008.

F-21

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)