Sallie Mae 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

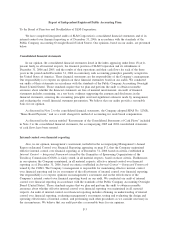

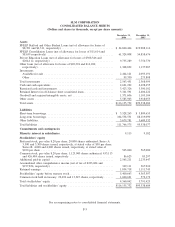

SLM CORPORATION

CONSOLIDATED BALANCE SHEETS

(Dollars and shares in thousands, except per share amounts)

December 31,

2006

December 31,

2005

Assets

FFELP Stafford and Other Student Loans (net of allowance for losses of

$8,701 and $6,311, respectively) ................................. $ 24,840,464 $19,988,116

FFELP Consolidation Loans (net of allowance for losses of $11,614 and

$8,639 respectively) .......................................... 61,324,008 54,858,676

Private Education Loans (net of allowance for losses of $308,346 and

$204,112, respectively) ........................................ 9,755,289 7,756,770

Other loans (net of allowance for losses of $20,394 and $16,180,

respectively) . . . ............................................. 1,308,832 1,137,987

Investments

Available-for-sale ............................................ 2,464,121 2,095,191

Other ..................................................... 99,330 273,808

Total investments . ............................................. 2,563,451 2,368,999

Cash and cash equivalents ........................................ 2,621,222 2,498,655

Restricted cash and investments.................................... 3,423,326 3,300,102

Retained Interest in off-balance sheet securitized loans................... 3,341,591 2,406,222

Goodwill and acquired intangible assets, net .......................... 1,371,606 1,105,104

Other assets .................................................. 5,585,943 3,918,053

Total assets ................................................... $116,135,732 $99,338,684

Liabilities

Short-term borrowings........................................... $ 3,528,263 $ 3,809,655

Long-term borrowings........................................... 104,558,531 88,119,090

Other liabilities . . . ............................................. 3,679,781 3,609,332

Total liabilities . . . ............................................. 111,766,575 95,538,077

Commitments and contingencies

Minority interest in subsidiaries .................................. 9,115 9,182

Stockholders’ equity

Preferred stock, par value $.20 per share, 20,000 shares authorized; Series A:

3,300 and 3,300 shares issued, respectively, at stated value of $50 per share;

Series B: 4,000 and 4,000 shares issued, respectively, at stated value of

$100 per share . ............................................. 565,000 565,000

Common stock, par value $.20 per share, 1,125,000 shares authorized: 433,113

and 426,484 shares issued, respectively ............................ 86,623 85,297

Additional paid-in capital ........................................ 2,565,211 2,233,647

Accumulated other comprehensive income (net of tax of $183,684 and

$197,834, respectively) ........................................ 349,111 367,910

Retained earnings . ............................................. 1,834,718 1,111,743

Stockholders’ equity before treasury stock ............................ 5,400,663 4,363,597

Common stock held in treasury: 22,496 and 13,347 shares, respectively ...... 1,040,621 572,172

Total stockholders’ equity ........................................ 4,360,042 3,791,425

Total liabilities and stockholders’ equity ............................. $116,135,732 $99,338,684

See accompanying notes to consolidated financial statements.

F-5