Sallie Mae 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FFELP loans. We also offer specialized loan products to graduate and professional students primarily through

our MBALoans», LAWLOANS»and MEDLOANS

SM

programs. Generally, these loans do not require

borrowers to begin repaying their loans until after graduation and allow a grace period from six to nine

months.

In the third quarter of 2004 we began to offer Tuition Answer

SM

loans directly to the consumer through

targeted direct mail campaigns and web-based initiatives. Under the Tuition Answer loan program, creditwor-

thy parents, sponsors and students may borrow between $1,500 and $40,000 per year to cover any college-

related expense. No school certification is required, although a borrower must provide enrollment documenta-

tion. At December 31, 2006, we had $1.9 billion of Tuition Answer loans outstanding.

We also offer alternative Private Education Loans for information technology, cosmetology, mechanics,

medical/dental/lab, culinary and broadcasting. On average, these career training programs typically last fewer

than 12 months. Generally, these loans require the borrower to begin repaying the loan immediately; however,

students can opt to make relatively small payments while enrolled. At December 31, 2006, we had $2.3 billion

of career training loans outstanding.

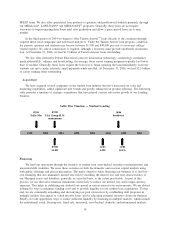

Acquisitions

We have acquired several companies in the student loan industry that have increased our sales and

marketing capabilities, added significant new brands and greatly enhanced our product offerings. The following

table provides a timeline of strategic acquisitions that have played a major role in the growth of our Lending

business.

Sallie Mae Timeline — Student Lending

07/99

Nellie Mae

07/00

SLFR

1999 2000 2001 2002 2003 2004 2005 2006

11/03

AMS

11/03

SLFA

07/00

USA Group-SLM

combination

10/04

Southwest

Financing

We fund our operations through the issuance of student loan asset-backed securities (securitizations) and

unsecured debt securities. We issue these securities in both the domestic and overseas capital markets using

both public offerings and private placements. The major objective when financing our business is to find low

cost financing that also minimizes interest rate risk by matching the interest rate and reset characteristics of

our Managed assets and liabilities, generally on a pooled basis, to the extent practicable. As part of this

process, we use derivative financial instruments extensively to reduce our interest rate and foreign currency

exposure. This helps in stabilizing our student loan spread in various interest rate environments. We are always

looking for ways to minimize funding costs and to provide liquidity for our student loan acquisitions. To that

end, we are continually expanding and diversifying our pool of investors by establishing debt programs in

multiple markets that appeal to varied investor bases and by educating potential investors about our business.

Finally, we take appropriate steps to ensure sufficient liquidity by financing in multiple markets, which include

the institutional, retail, floating-rate, fixed-rate, unsecured, asset-backed, domestic and international markets.

14