Sallie Mae 2006 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

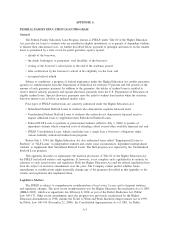

Eligible schools include institutions of higher education, including proprietary institutions, meeting the

standards provided in the Higher Education Act. For a school to participate in the program, the Department of

Education must approve its eligibility under standards established by regulation.

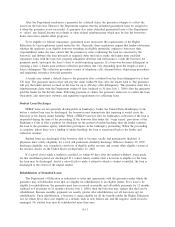

Financial Need Analysis

Subject to program limits and conditions, student loans generally are made in amounts sufficient to cover

the student’s estimated costs of attending school, including tuition and fees, books, supplies, room and board,

transportation and miscellaneous personal expenses as determined by the institution. Generally, each loan

applicant (and parents in the case of a dependent child) must undergo a financial need analysis. This requires

the applicant (and parents in the case of a dependent child) to submit financial data to a federal processor. The

federal processor evaluates the parents’ and student’s financial condition under federal guidelines and

calculates the amount that the student and the family are expected to contribute towards the student’s cost of

education. After receiving information on the family contribution, the institution then subtracts the family

contribution from the student’s estimated costs of attending to determine the student’s need for financial aid.

Some of this need may be met by grants, scholarships, institutional loans and work assistance. A student’s

“unmet need” is further reduced by the amount of loans for which the borrower is eligible.

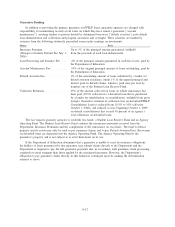

Special Allowance Payments

The Higher Education Act provides for quarterly special allowance payments to be made by the

Department of Education to holders of student loans to the extent necessary to ensure that they receive at least

specified market interest rates of return. The rates for special allowance payments depend on formulas that

vary according to the type of loan, the date the loan was made and the type of funds, tax-exempt or taxable,

used to finance the loan. The Department makes a special allowance payment for each calendar quarter.

The special allowance payment equals the average unpaid principal balance, including interest which has

been capitalized, of all eligible loans held by a holder during the quarterly period multiplied by the special

allowance percentage.

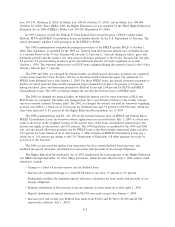

For student loans disbursed before January 1, 2000, the special allowance percentage is computed by:

(1) determining the average of the bond equivalent rates of 91-day Treasury bills auctioned for that

quarter;

(2) subtracting the applicable borrower interest rate;

(3) adding the applicable special allowance margin described in the table below; and

(4) dividing the resultant percentage by 4.

If the result is negative, the special allowance payment is zero.

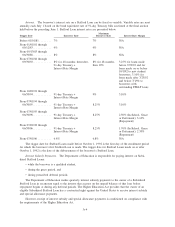

Date of First Disbursement Special Allowance Margin

Before 10/17/86 ................ 3.50%

From 10/17/86 through 09/30/92 .... 3.25%

From 10/01/92 through 06/30/95 .... 3.10%

From 07/01/95 through 06/30/98 .... 2.50% for Stafford Loans that are in In-School, Grace or Deferment

3.10% for Stafford Loans that are in Repayment and all other loans

From 07/01/98 through 12/31/99 .... 2.20% for Stafford Loans that are in In-School, Grace or Deferment

2.80% for Stafford Loans that are in Repayment 3.10% for PLUS,

SLS and FFELP Consolidation Loans

For student loans disbursed on or after January 1, 2000, the special allowance percentage is computed by:

(1) determining the average of the bond equivalent rates of 3-month commercial paper (financial)

rates quoted for that quarter;

(2) subtracting the applicable borrower interest rate;

A-4