Sallie Mae 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

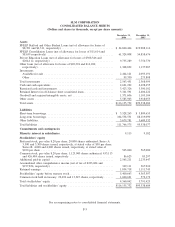

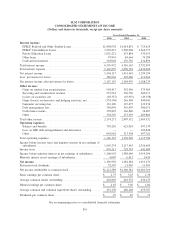

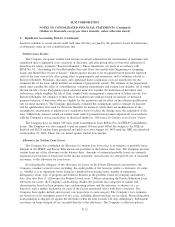

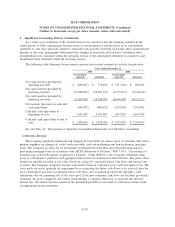

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

2006

Restated

2005

Restated

2004

Years Ended December 31,

Operating activities

Net income ....................................................... $ 1,156,956 $ 1,382,284 $ 1,913,270

Adjustments to reconcile net income to net cash (used in) provided by operating activities:

Gains on student loan securitizations ..................................... (902,417) (552,546) (375,384)

Losses on securities, net ............................................. 49,357 63,955 49,358

Stock-based compensation expense ...................................... 81,163 19,592 18,844

Loss on GSE debt extinguishment and defeasance ............................. — — 220,848

Unrealized (gains)/losses on derivative and hedging activities, excluding equity forwards ..... (128,529) (514,362) (802,548)

Unrealized (gains)/losses on derivative and hedging activities — equity forwards .......... 359,193 (120,433) (759,423)

Provisions for losses................................................ 286,962 203,006 111,066

Minority interest, net ............................................... (2,461) (7,835) (502)

Mortgage loans originated ............................................ (1,291,782) (1,746,986) (1,461,979)

Proceeds from sales of mortgage loans .................................... 1,364,448 1,692,923 1,257,574

Decrease in restricted cash — other ...................................... 71,312 18,640 27,476

(Increase) in accrued interest receivable ................................... (970,580) (788,819) (467,745)

Increase in accrued interest payable ...................................... 277,617 260,505 162,018

Adjustment for non-cash (income)/loss related to Retained Interest ................... 157,715 258,351 85,767

Decrease in other assets, goodwill and acquired intangible assets, net ................. 515,305 218,905 680,646

(Decrease) increase in other liabilities ..................................... (215,838) 371,650 (54,461)

Total adjustments ................................................. (348,535) (623,454) (1,308,445)

Net cash provided by operating activities ................................... 808,421 758,830 604,825

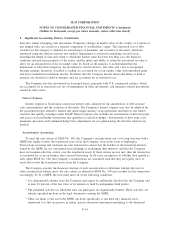

Investing activities

Student loans acquired .............................................. (36,364,686) (29,463,704) (22,798.642)

Loans purchased from securitized trusts (primarily loan consolidations) ................ (7,394,655) (9,491,668) (5,552,467)

Reduction of student loans:

Installment payments, claims and other . ................................. 10,569,365 8,503,141 5,818,541

Proceeds from securitization of student loans treated as sales ..................... 19,521,365 13,520,208 12,475,726

Proceeds from sales of student loans .................................... 101,212 167,410 478,402

Other loans — originated ............................................. (2,082,670) (565,070) (403,156)

Other loans — repaid ............................................... 1,834,471 523,473 593,261

Other investing activities, net .......................................... (210,969) (192,684) (16,907)

Purchases of available-for-sale securities ................................... (85,189,100) (66,259,431) (292,819,925)

Proceeds from sales of available-for-sale securities ............................. 25,941 624,960 124,205

Proceeds from maturities of available-for-sale securities ......................... 85,015,345 66,700,950 293,743,096

Purchases of held-to-maturity and other securities ............................. (1,066,290) (903,328) (292,330)

Proceeds from maturities of held-to-maturity securities and other securities . . ........... 1,278,897 904,179 275,567

(Increase) in restricted cash — on-balance sheet trusts........................... (304,749) (990,961) (818,652)

Return of investment from Retained Interest ................................. 140,435 256,712 449,539

Purchase of subsidiaries, net of cash acquired ................................ (339,836) (237,919) (868,404)

Net cash used in investing activities ...................................... (14,465,924) (16,903,732) (9,612,146)

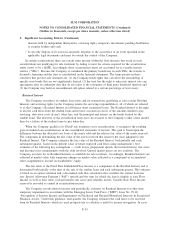

Financing activities

Short-term borrowings issued .......................................... 16,803,116 59,820,213 290,973,916

Short-term borrowings repaid .......................................... (16,618,913) (59,907,574) (298,108,496)

Long-term borrowings issued .......................................... 11,739,249 10,250,879 15,439,912

Long-term borrowings repaid .......................................... (4,744,432) (1,835,538) (14,620,785)

Borrowings collateralized by loans in trust — issued............................ 12,984,937 12,913,991 21,584,931

Borrowings collateralized by loans in trust — activity ........................... (5,584,441) (5,359,329) (1,868,402)

GSE debt extinguishment ............................................ — — (1,967,607)

Other financing activities, net .......................................... (41,837) (119,050) —

Excess tax benefit from the exercise of stock-based awards ....................... 32,985 — —

Common stock issued ............................................... 192,520 249,944 266,009

Net settlements on equity forward contracts ................................. (66,925) (52,965) (34,148)

Common stock repurchased ........................................... (482,855) (732,342) (777,293)

Common dividends paid ............................................. (398,414) (355,368) (321,313)

Preferred stock issued ............................................... — 396,745 —

Preferred dividends paid ............................................. (34,920) (21,536) (11,501)

Net cash provided by financing activities ................................... 13,780,070 15,248,070 10,555,223

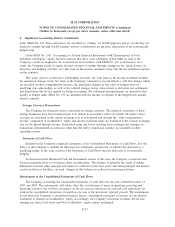

Net increase (decrease) in cash and cash equivalents ............................. 122,567 (896,832) 1,547,902

Cash and cash equivalents at beginning of year ................................ 2,498,655 3,395,487 1,847,585

Cash and cash equivalents at end of year ................................... $ 2,621,222 $ 2,498,655 $ 3,395,487

Cash disbursements made for:

Interest ........................................................ $ 4,512,737 $ 2,587,582 $ 1,214,249

Income taxes .................................................... $ 770,004 $ 476,923 $ 549,319

Noncash financing activity:

Transfer of investments to trust to defease GSE debt ........................... $ — $ — $ 1,305,906

See accompanying notes to consolidated financial statements.

F-9