Sallie Mae 2006 Annual Report Download - page 144

Download and view the complete annual report

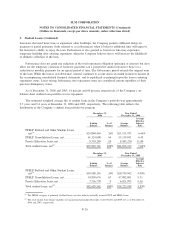

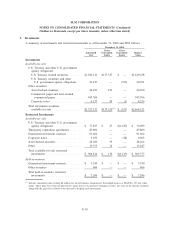

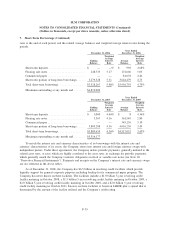

Please find page 144 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Student Loans (Continued)

There are three principal categories of FFELP loans: Stafford, PLUS, and FFELP Consolidation Loans.

Generally, Stafford and PLUS loans have repayment periods of between five and ten years. FFELP

Consolidation Loans have repayment periods of twelve to thirty years. FFELP loans do not require repayment,

or have modified repayment plans, while the borrower is in-school and during the grace period immediately

upon leaving school. The borrower may also be granted a deferment or forbearance for a period of time based

on need, during which time the borrower is not considered to be in repayment. Interest continues to accrue on

loans in the in-school, deferment and forbearance period. FFELP loans obligate the borrower to pay interest at

a stated fixed rate or a variable rate reset annually (subject to a cap) on July 1 of each year depending on

when the loan was originated and the loan type. The Company earns interest at the greater of the borrower’s

rate or a floating rate based on the SAP formula, with the interest earned on the floating rate that exceeds the

interest earned from the borrower being paid directly by ED. In low or certain declining interest rate

environments when student loans are earning at the fixed borrower rate, while the interest on the funding for

the loans is variable and declining, the Company can earn additional spread income that it refers to as Floor

Income. For loans disbursed after April 1, 2006, FFELP loans effectively only earn at the SAP rate, as the

excess interest earned when the borrower rate exceeds the SAP rate (Floor Income) must be refunded to ED.

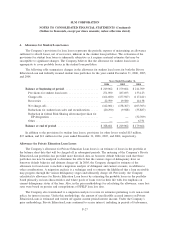

For FFELP loan portfolios, the Company’s loan servicing division, Sallie Mae Servicing, has met the

performances standards to be designated as an Exceptional Performer (“EP”) by ED. As a result of this

designation, the Company receives 99 percent reimbursement on default claims filed on or after July 1, 2006

on FFELP loans that are serviced by Sallie Mae Servicing for a period of at least 270 days before the date of

default as mandated by the Reconciliation Legislation. For claims filed prior to July 1, 2006, the rate of

reimbursement was 100 percent. As a result of the amended reimbursement level, the Company established an

allowance at December 31, 2005 for loans that will be subject to a one-percent Risk Sharing provision.

The Company is subject to the EP Risk Sharing rate as long as it remains in compliance with the required

servicing standards, which are assessed on an annual and quarterly basis through compliance audits and other

criteria. As of December 31, 2006, the EP designation also applies to all FFELP loans that the Company owns

but are serviced by other service providers with the EP designation and conversely does not apply for loans

serviced by other service providers without the EP designation. Prior to being designated as an EP in 2005,

the Company was subject to the two-percent Risk Sharing on these loans. The Reconciliation Legislation

increased the Risk Sharing for non-designated EP’s to three percent, effective with new disbursements on or

after July 1, 2006.

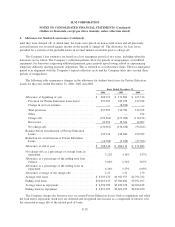

In addition to FFELP loan programs, which place statutory limits on per year and total borrowing, the

Company offers a variety of Private Education Loans. Private Education Loans for post-secondary education

and loans for career training can be subdivided into two main categories: loans that supplement FFELP student

loans primarily for higher and lifelong learning programs and loans for career training. For the majority of the

Private Education Loan portfolio, the Company bears the full risk of any losses experienced and as a result,

these loans are underwritten and priced based upon standardized consumer credit scoring criteria. In addition,

students who do not meet the Company’s minimum underwriting standards are generally required to obtain a

credit-worthy co-borrower. Approximately 50 percent of the Company’s Private Education Loans have a co-

borrower.

Private Education Loans are not federally guaranteed nor insured against any loss of principal or interest.

Traditional student borrowers use the proceeds of these loans to obtain higher education. The Company

believes the borrowers’ repayment capability improves between the time the loan is made and the time they

enter the post-education work force. The Company generally allows the loan repayment period on traditional

higher education Private Education Loans to begin six months after the borrower leaves school (consistent with

FFELP loans). This provides the borrower time after graduation to obtain a job to service the debt. For

F-25

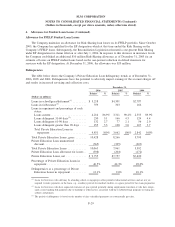

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)