Sallie Mae 2006 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

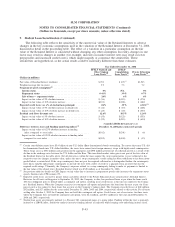

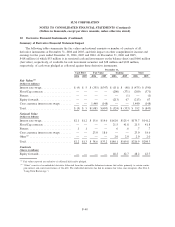

9. Student Loan Securitization (Continued)

Residual Interest in Securitized Receivables

The following tables summarize the fair value of the Company’s Residual Interests (and the assumptions

used to value such Residual Interests), along with the underlying off-balance sheet student loans that relate to

those securitizations in transactions that were treated as sales as of December 31, 2006 and 2005.

FFELP

Stafford and

PLUS

FFELP

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2006

(Dollars in millions)

Fair value of Residual Interests

(2)

.......................... $ 701 $ 676 $ 1,965 $ 3,342

Underlying securitized loan balance

(3)

....................... 14,794 17,817 13,222 45,833

Weighted average life ................................. 2.9yrs. 7.3 yrs. 7.2 yrs.

Prepayment speed (annual rate)

(4)

Interim status

(5)

.................................... 0% N/A 0%

Repayment status

(5)

................................. 0-43% 3-9% 4-7%

Life of loan — repayment status

(5)

....................... 24% 6% 6%

(7)

Expected credit losses

(% of student loan principal) ........................... .06% .07% 4.36%

Residual cash flows discount rate . . . ....................... 12.6% 10.5% 12.6%

FFELP

Stafford and

PLUS

FFELP

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2005

(Dollars in millions)

Fair value of Residual Interests

(2)

......................... $ 774 $ 483 $ 1,149 $ 2,406

Underlying securitized loan balance

(3)

...................... 20,372 10,272 8,946 39,590

Weighted average life . . .............................. 2.7yrs. 8.0 yrs. 7.8 yrs.

Prepayment speed (annual rate)

(4)

......................... 10%-20%

(6)

6% 4%

Expected credit losses

(% of student loan principal) . ......................... .14% .23% 4.74%

Residual cash flows discount rate ......................... 12.3% 10.3% 12.4%

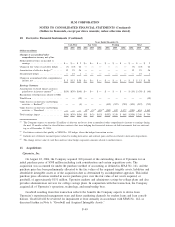

(1)

Includes $151 million and $235 million related to the fair value of the Embedded Floor Income as of December 31, 2006 and

2005, respectively. Changes in the fair value of the Embedded Floor Income are primarily due to changes in the interest rates

and the paydown of the underlying loans.

(2)

At December 31, 2006 and 2005, the Company had unrealized gains (pre-tax) in accumulated other comprehensive income of

$389 million and $370 million, respectively.

(3)

In addition to student loans in off-balance sheet trusts, the Company had $48.6 billion and $40.9 billion of securitized student

loans outstanding (face amount) as of December 31, 2006 and 2005, respectively, in on-balance sheet FFELP Consolidation Loan

securitization trusts.

(4)

Effective December 31, 2006, the Company implemented CPR curves for Residual Interest valuations that are based on the num-

ber of months since entering repayment that better reflect the CPR as the loan seasons. Under this methodology, a different CPR

is applied to each year of a loan’s seasoning. Previously, the Company applied a CPR that was based on a static life of loan

assumption, irrespective of seasoning, or, in the case of FFELP Stafford and PLUS loans, the Company used a vector approach

in applying the CPR. The change in CPR methodology resulted in an immaterial change in the fair value of the Residual Interest.

The CPR assumption used for all periods includes the impact of projected defaults.

(5)

The repayment status CPR depends on the number of months since first entering repayment or as the loan seasons through the

portfolio. Life of loan CPR is related to repayment status only and does not include the impact of the loan while in interim

status.

(6)

The CPRs used for December 31, 2005 FFELP Stafford and PLUS valuations were 20 percent for 2006, 15 percent for 2007 and

10 percent thereafter.

(7)

During 2006, the Company and others in the industry began consolidating Private Education Loans. As a result, the Company

experienced an increase in actual prepayment speeds primarily related to this new consolidation activity. The Company expects

such consolidation activity to continue going forward and, as a result, the CPR assumption was increased from 4 percent to 6 per-

cent as of December 31, 2006. As of December 31, 2006, $304 million of the $389 million in the accumulated other comprehen-

sive income relates to the Private Education Loan trusts.

F-41

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)