Sallie Mae 2006 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

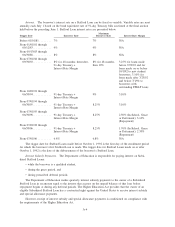

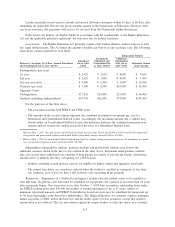

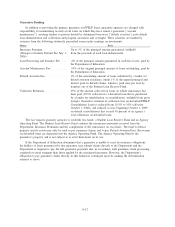

Trigger Date Borrower Rate

Maximum

Borrower Rate

Interest

Rate

Margin

Before 10/01/81 . . . . . . . . . . . . . . . . . 9% 9% N/A

From 10/01/81 through 10/30/82 . . . . . 14% 14% N/A

From 11/01/82 through 06/30/87 . . . . . 12% 12% N/A

From 07/01/87 through 09/30/92 . . . . . 1-year Index + Interest Rate Margin 12% 3.25%

From 10/01/92 through 06/30/94 . . . . . 1-year Index + Interest Rate Margin PLUS 10%, SLS 11% 3.10%

From 07/01/94 through 06/30/98 . . . . . 1-year Index + Interest Rate Margin 9% 3.10%

From 6/30/98 through 06/30/06 . . . . . . 91-day Treasury + Interest Rate Margin 9% 3.10%

From 07/01/06 . . . . . . . . . . . . . . . . . . 8.5% 8.5% N/A

For PLUS and SLS Loans made before October 1, 1992, the trigger date is the first day of the enrollment

period for which the loan was made. For PLUS and SLS Loans made on or after October 1, 1992, the trigger

date is the date of the disbursement of the loan.

A holder of a PLUS or SLS Loan is eligible to receive special allowance payments during any quarter if:

• the borrower rate is set at the maximum borrower rate and

• the sum of the average of the bond equivalent rates of 3-month Treasury bills auctioned during that

quarter and the applicable interest rate margin exceeds the maximum borrower rate.

Effective July 1, 2006, this limitation on special allowance for PLUS loans made on and after January 1, 2000

is repealed.

Repayment, Deferments. Borrowers begin to repay principal of their PLUS and SLS Loans no later than

60 days after the final disbursement. Deferment and forbearance provisions, maximum loan repayment periods

and minimum payment amounts for PLUS and SLS Loans are the same as those for Stafford Loans.

Consolidation Loan Program

The Higher Education Act also authorizes a program under which borrowers may consolidate one or more

of their student loans into a single FFELP Consolidation Loan that is insured and reinsured on a basis similar

to Stafford and PLUS Loans. FFELP Consolidation Loans are made in an amount sufficient to pay outstanding

principal, unpaid interest, late charges and collection costs on all federally reinsured student loans incurred

under the FFELP that the borrower selects for consolidation, as well as loans made under various other federal

student loan programs and loans made by different lenders. In general, a borrower’s eligibility to consolidate

FFELP student loans ends upon receipt of a FFELP Consolidation Loan. Under certain circumstances, a

FFELP borrower may obtain a FFELP Consolidation Loan under the FDLP.

FFELP Consolidation Loans made on or after July 1, 1994 have no minimum loan amount, although

FFELP Consolidation Loans for less than $7,500 do not enjoy an extended repayment period. Applications for

FFELP Consolidation Loans received on or after January 1, 1993 but before July 1, 1994 were available only

to borrowers who had aggregate outstanding student loan balances of at least $7,500. For applications received

before January 1, 1993, FFELP Consolidation Loans were available only to borrowers who had aggregate

outstanding student loan balances of at least $5,000.

To obtain a FFELP Consolidation Loan, the borrower must be either in repayment status or in a grace

period before repayment begins. In addition, for applications received before January 1, 1993, the borrower

must not have been delinquent by more than 90 days on any student loan payment. Prior to July 1, 2006,

married couples who were eligible to consolidate agreed to be jointly and severally liable and were treated as

one borrower for purposes of loan consolidation eligibility.

FFELP Consolidation Loans bear interest at a fixed rate equal to the greater of the weighted average of

the interest rates on the unpaid principal balances of the consolidated loans and 9 percent for loans originated

before July 1, 1994. For FFELP Consolidation Loans made on or after July 1, 1994 and for which applications

A-9