Sallie Mae 2006 Annual Report Download - page 189

Download and view the complete annual report

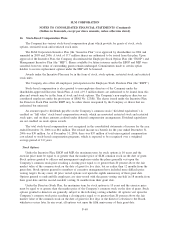

Please find page 189 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investment Policy and Strategy

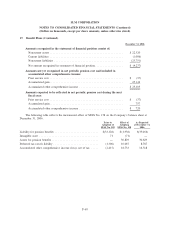

The principle objectives of the asset allocation policy are to maximize return while preserving principal

during declining phases of the market cycle and to maintain cash reserves sufficient to assure timely payment

of benefit obligations. A maximum of 85 percent of the plan’s assets can be invested in equity securities with

the balance in fixed income securities and cash equivalents. Each of the plan’s U.S. equity focused fund

managers follows a value oriented investment strategy. The current money market position is being held for

benefit payments and in anticipation of allocating funds to an international fund manager once the final

selection is made. In 2006, the plan engaged an international equity fund manager which employs an intrinsic

value investment strategy. The current money market position is being held for benefit payments. The

Company intends to review the plan’s asset allocation in 2007, in light of the fact that benefit accruals will

cease in 2009.

Cash Flows

The Company did not contribute to its qualified pension plan in 2006 and does not expect to contribute in

2007. There are no plan assets in the nonqualified plans due to the nature of the plans, and benefits are paid

from corporate assets when due to the participant. It is estimated that approximately $2 million will be paid in

2007 for these benefits. No plan assets are expected to be returned to the employer during 2007.

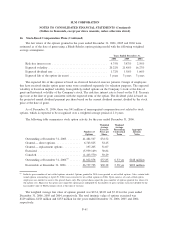

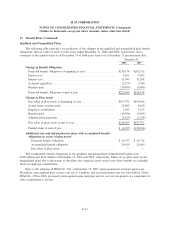

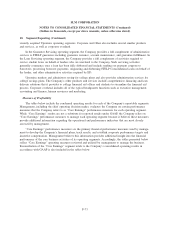

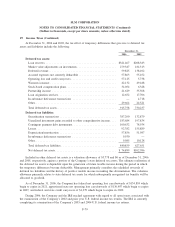

Estimated Future Benefit Payments

The following qualified and nonqualified plan benefit payments, which reflect future service as appropri-

ate, are expected to be paid:

2007 ................................................................ $15,850

2008 ................................................................ 17,719

2009 ................................................................ 16,991

2010 ................................................................ 17,790

2011 ................................................................ 17,798

2012-2016 ............................................................ 82,819

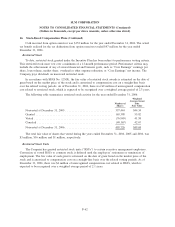

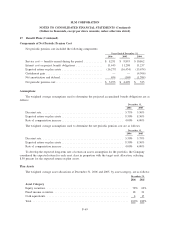

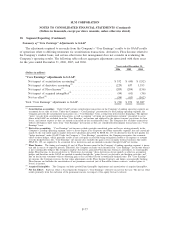

401(k) Plans

The Company maintains two safe harbor 401(k) savings plans as defined contribution plans intended to

qualify under section 401(k) of the Internal Revenue Code. The Sallie Mae 401(k) Savings Plan covers

substantially all employees of the Company outside of Debt Management Operations. Participating employees

as of July 1, 2005 may contribute up to 75 percent of eligible compensation; between July 1, 2004 and

June 30, 2005 the maximum deferral percentage was 25 percent, and prior to July 1, 2004 the maximum

deferral was 10 percent of eligible compensation. Up to 6 percent of these contributions are matched

100 percent by the Company after one year of service. Effective July 1, 2004, in conjunction with the defined

benefit plan change, certain eligible employees began receiving a 2 percent core employer contribution. As

additional employees phase out of the Pension Plans, they will begin receiving the 2 percent core employer

contribution.

The Sallie Mae DMO 401(k) Savings Plan (“DMO Plan”) covers substantially all employees of Debt

Management Operations. Eligible employees can contribute up to 75 percent of eligible compensation as of

July 1, 2005 and up to 25 percent of eligible compensation between July 1, 2004 and July 1, 2005. The DMO

F-70

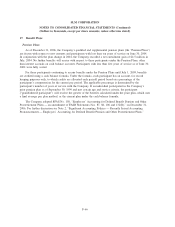

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

17. Benefit Plans (Continued)