Sallie Mae 2006 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

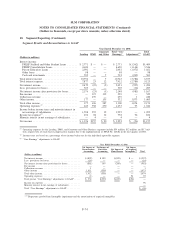

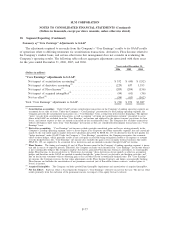

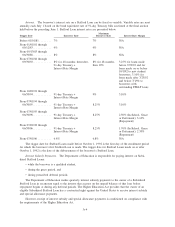

20. Quarterly Financial Information (unaudited)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2006

Net interest income ............................ $387,521 $ 356,805 $ 337,821 $ 371,970

Less: provisions for losses ....................... 60,319 67,396 67,242 92,005

Net interest income after provisions for losses ......... 327,202 289,409 270,579 279,965

Gains (losses) on derivative and hedging activities, net . . (86,739) 122,719 (130,855) (244,521)

Other income ................................. 372,582 1,011,435 682,027 447,623

Operating expenses............................. 323,309 316,602 353,494 352,747

Income taxes ................................. 137,045 381,828 203,686 111,752

Minority interest in net earnings of subsidiaries ........ 1,090 1,355 1,099 463

Net income .................................. 151,601 723,778 263,472 18,105

Preferred stock dividends ........................ 8,301 8,787 9,221 9,258

Net income attributable to common stock ............ $143,300 $ 714,991 $ 254,251 $ 8,847

Basic earnings per common share .................. $ .35 $ 1.74 $ .62 $ .02

Diluted earnings per common share ................ $ .34 $ 1.52 $ .60 $ .02

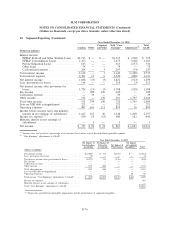

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

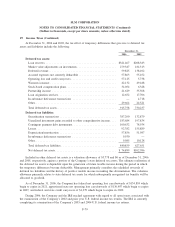

2005

Net interest income .............................. $346,760 $ 329,788 $384,764 $390,133

Less: provisions for losses ......................... 46,523 78,948 12,217 65,318

Net interest income after provisions for losses ........... 300,237 250,840 372,547 324,815

Gains (losses) on derivative and hedging activities, net . . . . (34,251) (105,940) 316,469 70,270

Other income ................................... 408,349 617,836 185,145 549,474

Operating expenses............................... 262,291 287,413 291,961 296,663

Income taxes ................................... 186,466 176,573 149,821 215,907

Minority interest in net earnings of subsidiaries .......... 2,194 2,235 1,029 954

Net income .................................... 223,384 296,515 431,350 431,035

Preferred stock dividends .......................... 2,875 3,908 7,288 7,832

Net income attributable to common stock .............. $220,509 $ 292,607 $424,062 $423,203

Basic earnings per common share .................... $ .52 $ .70 $ 1.02 $ 1.02

Diluted earnings per common share .................. $ .49 $ .66 $ .95 $ .96

F-80

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)