Sallie Mae 2006 Annual Report Download - page 170

Download and view the complete annual report

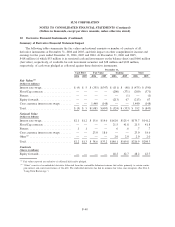

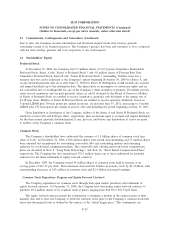

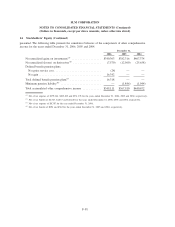

Please find page 170 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11. Acquisitions (Continued)

DMO business segment. Goodwill will be reviewed for impairment at least annually in accordance with

SFAS No. 142, as discussed further in Note 6, “Goodwill and Acquired Intangible Assets.”

Identifiable intangible assets at each respective acquisition date include AFS’s trade name, an indefinite

life intangible asset, with an aggregate fair value of approximately $15 million as of the acquisition dates and

definite life intangible assets with aggregate fair values of approximately $22 million as of the acquisition

dates, $20 million of which is attributed to customer relationships.

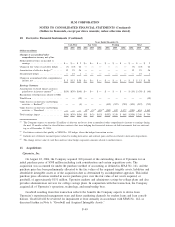

GRP/AG Holdings, LLC

On August 31, 2005, the Company acquired 100 percent controlling interest in GRP/AG Holdings, LLC

and its subsidiaries (collectively, “GRP”) for a purchase price of approximately $137 million including cash

consideration and certain acquisition costs. GRP engages in the acquisition and resolution of distressed

residential mortgage loans and foreclosed residential properties. In the third quarter of 2006, the Company

finalized its purchase price allocation for GRP, which resulted in an excess purchase price over the fair value

of net assets acquired, or goodwill, of $53 million.

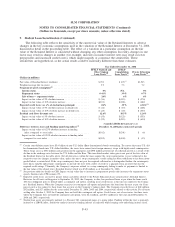

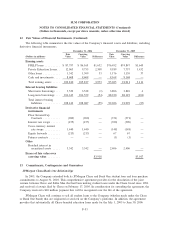

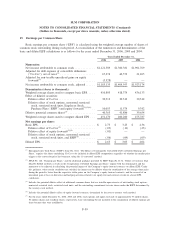

12. Fair Values of Financial Instruments

SFAS No. 107, “Disclosures about Fair Value of Financial Instruments,” requires the estimation of the

fair values of financial instruments. The following is a summary of the assumptions and methods used to

estimate those values.

Student Loans

For both FFELP loans and Private Education Loans, fair value was determined by modeling loan level

cash flows using stated terms of the assets and internally-developed assumptions to determine aggregate

portfolio yield, net present value and average life. The significant assumptions used to project cash flows are

prepayment speeds, default rates, and expected Borrower Benefits to be earned. In addition, the Floor Income

component of the Company’s FFELP loan portfolio is valued through discounted cash flow and option models

using both observable market inputs and internally developed inputs.

Other Loans

The fair values of warehousing and facilities financings were determined through standard bond pricing

models using observable market inputs adjusted for credit spreads. The fair values of consumer and mortgage

loans were determined by modeling cash flows aggregated by loan type using observable market inputs to

determine portfolio yield, net present value and average life.

Cash and Investments (Including “Restricted”)

For all cash and cash equivalents, carrying value approximated fair value. Investments in U.S. Treasury

securities, securities issued by U.S. government agencies, and corporate notes were valued using observable

market prices. U.S. Treasury-backed securities and all other investments were valued through standard bond

pricing models using observable market inputs adjusted for credit spreads.

F-51

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)