Sallie Mae 2006 Annual Report Download - page 62

Download and view the complete annual report

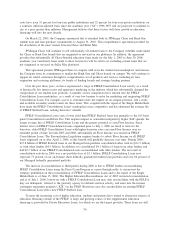

Please find page 62 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• the level of Floor Income; and when considering the “Core Earnings” managed spread, the amount of

Floor Income-eligible loans that have been hedged through Floor Income Contracts; and

• funding and hedging costs.

The student loan spread is highly susceptible to liquidity, funding and interest rate risk. These risks are

discussed separately at “LIQUIDITY AND CAPITAL RESOURCES” and in the “RISK FACTORS” discussion

at the front of the document.

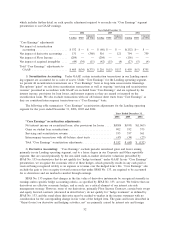

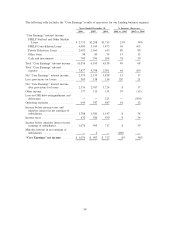

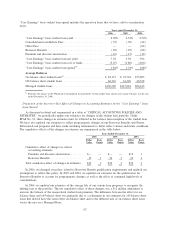

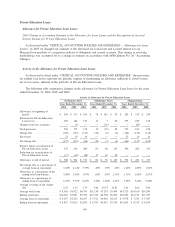

Student Loan Spread Analysis — “Core Earnings” Basis

The following table analyzes the earnings from our portfolio of Managed student loans on a “Core

Earnings” basis (see “BUSINESS SEGMENTS — Pre-tax Differences between ‘Core Earnings’ and GAAP by

Business Segment”). The “Core Earnings” Basis Student Loan Spread Analysis presentation and certain

components used in the calculation differ from the On-Balance Sheet Student Loan Spread Analysis

presentation. The “Core Earnings” basis presentation, when compared to our on-balance sheet presentation, is

different in that it:

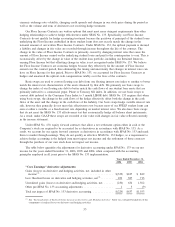

• includes the net interest margin related to our off-balance sheet student loan securitization trusts. This

includes any related fees or costs such as the Consolidation Loan Rebate Fees, premium/discount

amortization and Borrower Benefits yield adjustments;

• includes the reclassification of certain derivative net settlement amounts. The net settlements on certain

derivatives that do not qualify as SFAS No. 133 hedges are recorded as part of the “gain (loss) on

derivative and hedging activities, net” line item on the income statement and are therefore not

recognized in the student loan spread. Under this presentation, these gains and losses are reclassified to

the income statement line item of the economically hedged item. For our “Core Earnings” basis student

loan spread, this would primarily include: (a) reclassifying the net settlement amounts related to our

written Floor Income Contracts to student loan interest income and (b) reclassifying the net settlement

amounts related to certain of our basis swaps to debt interest expense;

• excludes unhedged Floor Income earned on the Managed student loan portfolio; and

• includes the amortization of upfront payments on Floor Income Contracts in student loan income that

we believe are economically hedging the Floor Income.

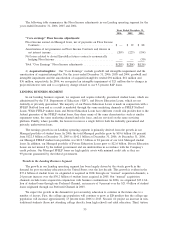

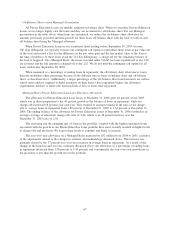

As discussed above, these differences result in the “Core Earnings” basis student loan spread not being a

GAAP-basis presentation. Management relies on this measure to manage our Lending business segment.

Specifically, management uses the “Core Earnings” basis student loan spread to evaluate the overall economic

effect that certain factors have on our student loans either on- or off-balance sheet. These factors include the

overall mix of student loans in our portfolio, acquisition costs, Borrower Benefits program costs, Floor Income

and funding and hedging costs. Management believes that it is important to evaluate all of these factors on a

“Core Earnings” basis to gain additional information about the economic effect of these factors on our student

loans under management. Management believes that this additional information assists us in making strategic

decisions about the Company’s business model for the Lending business segment, including among other

factors, how we acquire or originate student loans, how we fund acquisitions and originations, what Borrower

Benefits we offer and what type of loans we purchase or originate. While management believes that the “Core

Earnings” basis student loan spread is an important tool for evaluating the Company’s performance for the

reasons described above, it is subject to certain general and specific limitations that investors should carefully

consider. See “BUSINESS SEGMENTS — Limitations of ‘Core Earnings.’ ” One specific limitation is that the

61