Sallie Mae 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

calculate to those provided by our counterparties on a monthly basis. Any significant differences are identified

and resolved appropriately.

SFAS No. 133 requires that changes in the fair value of derivative instruments be recognized currently in

earnings unless specific hedge accounting criteria as specified by SFAS No. 133 are met. We believe that all

of our derivatives are effective economic hedges and are a critical element of our interest rate risk management

strategy. However, under SFAS No. 133, some of our derivatives, primarily Floor Income Contracts, certain

Eurodollar futures contracts, basis swaps and equity forwards, do not qualify for “hedge treatment” under

SFAS No. 133. Therefore, changes in market value along with the periodic net settlements must be recorded

through the “gains (losses) on derivative and hedging activities, net” line in the income statement with no

consideration for the corresponding change in fair value of the hedged item. The derivative market value

adjustment is primarily caused by interest rate and foreign currency exchange rate volatility, changing credit

spreads during the period, and changes in our stock price (related to equity forwards) as well as, the volume

and term of derivatives not receiving hedge accounting treatment. See also “BUSINESS SEGMENTS —

Limitations of ‘Core Earnings’ — Pre-tax Differences between ‘Core Earnings’ and GAAP by Business

Segment — Derivative Accounting” for a detailed discussion of our accounting for derivatives.

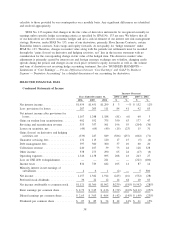

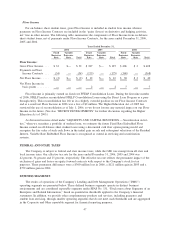

SELECTED FINANCIAL DATA

Condensed Statements of Income

2006 2005 2004 $ % $ %

Years Ended December 31, 2006 vs. 2005 2005 vs. 2004

Increase (Decrease)

Net interest income.................... $1,454 $1,451 $1,299 $ 3 —% $ 152 12%

Less: provisions for losses .............. 287 203 111 84 41 92 83

Net interest income after provisions for

losses ............................ 1,167 1,248 1,188 (81) (6) 60 5

Gains on student loan securitizations ....... 902 552 375 350 63 177 47

Servicing and securitization revenue ....... 553 357 561 196 55 (204) (36)

Losses on securities, net ................ (49) (64) (49) (15) (23) 15 31

Gains (losses) on derivative and hedging

activities, net ...................... (339) 247 849 (586) (237) (602) (71)

Guarantor servicing fees ................ 132 115 120 17 15 (5) (4)

Debt management fees ................. 397 360 300 37 10 60 20

Collections revenue ................... 240 167 39 73 44 128 328

Other income ........................ 338 273 290 65 24 (17) (6)

Operating expenses .................... 1,346 1,138 895 208 18 243 27

Loss on GSE debt extinguishment ......... — — 221 — — (221) (100)

Income taxes ........................ 834 729 642 105 14 87 14

Minority interest in net earnings of

subsidiaries ........................ 4 6 1 (2) — 5 500

Net income ......................... 1,157 1,382 1,914 (225) (16) (532) (28)

Preferred stock dividends ............... 36 22 12 14 64 10 83

Net income attributable to common stock . . . $1,121 $1,360 $1,902 $(239) (18)% $ (542) (28)%

Basic earnings per common share ......... $ 2.73 $ 3.25 $ 4.36 $ (.52) (16)% $(1.11) (25)%

Diluted earnings per common share........ $ 2.63 $ 3.05 $ 4.04 $ (.42) (14)% $ (.99) (25)%

Dividends per common share ............ $ .97 $ .85 $ .74 $ .12 14% $ .11 15%

38