Sallie Mae 2006 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11. Acquisitions (Continued)

Identifiable intangible assets at the acquisition date include the Upromise trade name, an indefinite life

intangible asset, with an aggregate fair value of approximately $31 million as of the acquisition date. Definite

life intangible assets with aggregate fair values of approximately $122 million as of the acquisition date

consist primarily of participant, member and partner relationships, and member deposits. These definite life

intangible assets will be amortized over one to 15 years depending on the economic benefit derived from each

of the underlying assets.

The Company’s purchase price allocation as of December 31, 2006 is preliminary as the Company is

awaiting the final results of a valuation that is being performed by an independent appraiser. The Company

does not anticipate any significant differences between its preliminary purchase price allocation and the final

allocation which the Company expects to complete by the end of the third quarter 2007.

The results of operations of Upromise have been included in the Company’s consolidated financial

statements since the acquisition date and are reflected within the Company’s Corporate and Other business

segment results as discussed further in Note 18, “Segment Reporting.” The acquisition and Upromise’s pro

forma results of operations prior to the acquisition date were deemed immaterial to the Company’s

consolidated financial statements.

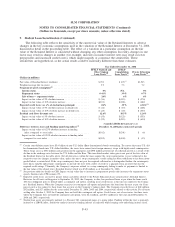

AFS Holdings, LLC

On December 29, 2006, the Company acquired an additional 12 percent interest in AFS for a purchase

price of approximately $51 million increasing the Company’s total purchase price for its 88 percent controlling

interest to approximately $277 million including cash consideration and certain acquisition costs. AFS is a

full-service, accounts receivable management company that purchases charged-off debt and performs third-

party receivables servicing across a number of consumer asset classes. Under the terms of the September 2004

purchase agreement, the Company has the option to purchase the remaining 12 percent minority interest in

AFS within the next year.

The results of operations of AFS have been included in the Company’s consolidated financial statements

since the acquisition of the Company’s initial 64 percent interest on September 16, 2004 and are reflected

within the Company’s DMO business segment results as discussed further in Note 18, “Segment Reporting.”

The acquisition and AFS’s pro forma results of operations prior to the acquisition date were deemed

immaterial to the Company’s consolidated financial statements.

The acquisition was accounted for under the purchase method of accounting as defined in SFAS No. 141.

During 2006, the Company finalized its purchase price allocation associated with its December 2005

acquisition of an additional 12 percent interest in AFS. The initial purchase price of $59 million has been

allocated to the fair values of the acquired tangible assets, liabilities assumed and identifiable intangible assets

as of the acquisition date as determined by an independent appraiser. The final purchase price allocation

resulted in an excess purchase price over the fair value of net assets acquired, or goodwill, of approximately

$53 million. The preliminary purchase price allocation associated with the December 2006 acquisition of an

additional 12 percent interest resulted in goodwill, of approximately $45 million increasing goodwill associated

with the Company’s acquisition of AFS to $207 million. The remaining fair value of AFS’s assets and

liabilities at each respective acquisition date was primarily allocated to purchased loan portfolios and other

identifiable intangible assets.

Goodwill resulting from these transactions reflects the benefits the Company expects to derive from

AFS’s experienced management team, existing servicing platform and several new asset classes in a new line

of business. It also reflects the benefits from the combined operations of AFS and the Company’s existing

F-50

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)