Sallie Mae 2006 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

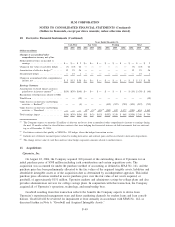

13. Commitments, Contingencies and Guarantees (Continued)

academic year (and future loans made to these borrowers) will be sold to the Company, including certain loans

that are not originated or serviced on Sallie Mae platforms.

This agreement permits JPMorgan Chase to compete with the Company in the student loan marketplace

and releases the Company from its commitment to market the Bank One and Chase brands on campus. The

Company will continue to support its school customers through its comprehensive set of products and services,

including its loan origination and servicing platforms, its family of lending brands and strategic lending

partners.

Other Commitments

The Company offers a line of credit to certain financial institutions and other institutions in the higher

education community for the purpose of buying or originating student loans. In the event that a line of credit

is drawn upon, the loan is collateralized by underlying student loans. The contractual amount of these financial

instruments represents the maximum possible credit risk should the counterparty draw down the commitment,

and the counterparty subsequently fails to perform according to the terms of its contract with the Company.

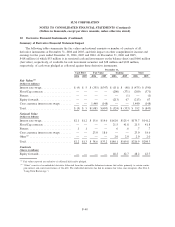

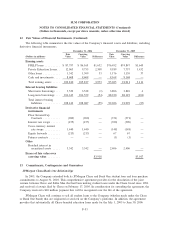

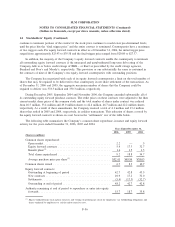

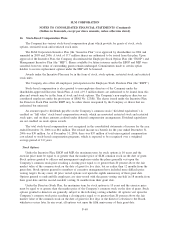

Commitments outstanding are summarized below:

2006 2005

December 31,

Student loan purchase commitments

(1)(2)

....................... $61,593,226 $50,701,995

Lines of credit .......................................... 2,145,624 1,489,403

$63,738,850 $52,191,398

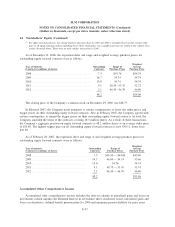

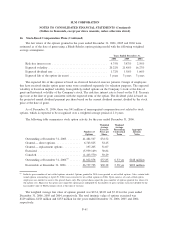

The following schedule summarizes expirations of commitments to the earlier of call date or maturity

date outstanding at December 31, 2006.

Student Loan

Purchases

(1)(2)

Lines of

Credit Total

2007 ...................................... $19,163,244 $ 559,291 $19,722,535

2008 ...................................... 20,991,645 302,824 21,294,469

2009 ...................................... 2,372,421 353,974 2,726,395

2010 ...................................... 7,071,403 729,543 7,800,946

2011 ...................................... 2,724,898 199,992 2,924,890

2012 ...................................... 9,269,615 — 9,269,615

Total ...................................... $61,593,226 $2,145,624 $63,738,850

(1)

Includes amounts committed at specified dates under forward contracts to purchase student loans and estimated future require-

ments to acquire student loans from lending partners based on expected future volumes at contractually committed rates.

(2)

These commitments are not accounted for as derivatives under SFAS No. 133 as they do not meet the definition of a derivative

due to the lack of a fixed and determinable purchase amount.

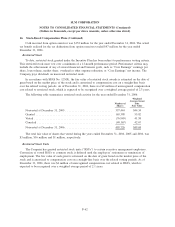

Contingencies

The Company is also subject to various claims, lawsuits and other actions that arise in the normal course

of business. Most of these matters are claims by borrowers disputing the manner in which their loans have

been processed or the accuracy of the Company’s reports to credit bureaus. In addition, the collections

subsidiaries in the Company’s debt management operation group are occasionally named in individual plaintiff

or class action lawsuits in which the plaintiffs allege that the Company has violated a federal or state law in

the process of collecting their account. Management believes that these claims, lawsuits and other actions will

not have a material adverse effect on its business, financial condition or results of operations. Finally, from

F-54

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)