Sallie Mae 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• the level of Floor Income and, when considering the “Core Earnings” spread, the amount of Floor

Income-eligible loans that have been hedged through Floor Income Contracts; and

• funding and hedging costs.

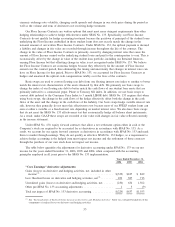

Wholesale Consolidation Loans

During 2006, we implemented a new loan acquisition strategy under which we began purchasing FFELP

Consolidation Loans outside of our normal origination channels, primarily via the spot market. We refer to

this new loan acquisition strategy as our Wholesale Consolidation Channel. FFELP Consolidation Loans

acquired through this channel are considered incremental volume to our core acquisition channels, which are

focused on the retail marketplace with an emphasis on our internal brand strategy. Wholesale Consolidation

Loans generally command significantly higher premiums than our originated FFELP Consolidation Loans, and

as a result, Wholesale Consolidation Loans have lower spreads. Since Wholesale Consolidation Loans are

acquired outside of our core loan acquisition channels and have different yields and return expectations than

the rest of our FFELP Consolidation Loan portfolio, we have excluded the impact of the Wholesale

Consolidation Loan volume from the student loan spread analysis to provide more meaningful period-over-per-

iod comparisons on the performance of our student loan portfolio. We will therefore discuss the volume and

its effect on the spread of the Wholesale Consolidation Loan portfolio separately.

The student loan spread is highly susceptible to liquidity, funding and interest rate risk. These risks are

discussed separately in “LIQUIDITY AND CAPITAL RESOURCES” and in the “RISK FACTORS”

discussion.

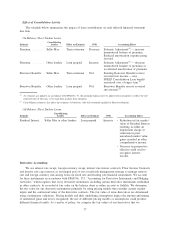

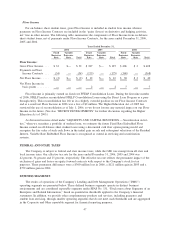

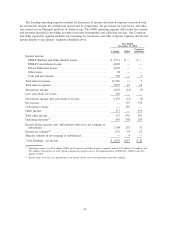

Student Loan Spread Analysis — On-Balance Sheet

The following table analyzes the reported earnings from on-balance sheet student loans. For an analysis

of our student loan spread for the entire portfolio of Managed student loans on a similar basis to the on-

balance sheet analysis, see “LENDING BUSINESS SEGMENT — Student Loan Spread Analysis — ‘Core

Earnings’ Basis.”

2006 2005 2004

Years Ended December 31,

On-Balance Sheet

Student loan yield, before Floor Income ..................... 7.94% 6.22% 4.53%

Gross Floor Income .................................... .04 .25 .73

Consolidation Loan Rebate Fees .......................... (.67) (.65) (.58)

Offset Fees . . . ....................................... — — (.03)

Borrower Benefits ..................................... (.12) (.11) (.18)

Premium and discount amortization ........................ (.14) (.16) (.13)

Student loan net yield .................................. 7.05 5.55 4.34

Student loan cost of funds ............................... (5.36) (3.69) (2.01)

Student loan spread

(1)

.................................. 1.69% 1.86% 2.33%

Average Balances

On-balance sheet student loans

(1)

.......................... $84,173 $74,724 $55,885

(1)

Excludes the impact of the Wholesale Consolidation Loan portfolio on the student loan spread and average balance for the year

ended December 31, 2006.

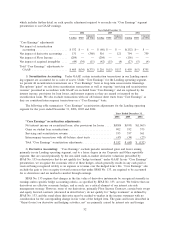

Discussion of Student Loan Spread — Effects of Floor Income and Derivative Accounting

In low interest rate environments, one of the primary drivers of fluctuations in our on-balance sheet

student loan spread is the level of gross Floor Income (Floor Income earned before payments on Floor Income

44