Sallie Mae 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

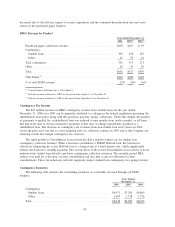

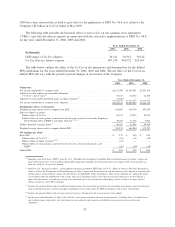

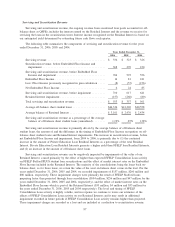

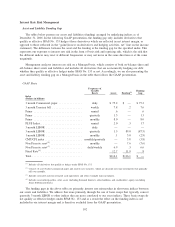

Residual Interest in Securitized Receivables

The following tables summarize the fair value of our Residual Interests and the assumptions used to value

such Residual Interests, along with the underlying off-balance sheet student loans that relate to those

securitizations in securitization transactions that were treated as sales as of December 31, 2006 and 2005.

FFELP

Stafford and

PLUS

FFELP

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2006

Fair value of Residual Interests

(2)

........... $ 701 $ 676 $ 1,965 $ 3,342

Underlying securitized loan balance

(3)

....... 14,794 17,817 13,222 45,833

Weighted average life ................... 2.9yrs. 7.3 yrs. 7.2 yrs

Prepayment speed (annual rate)

(4)

Interim status

(5)

...................... 0% n/a 0%

Repayment status

(5)

................... 0-43% 3-9% 4-7%

Life of loan — repayment status

(5)

........ 24% 6% 6%

(7)

Expected credit losses (% of student loan

principal)........................... .06% .07% 4.36%

Residual cash flows discount rate ........... 12.6% 10.5% 12.6%

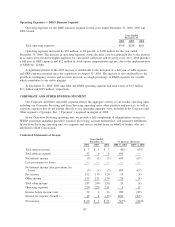

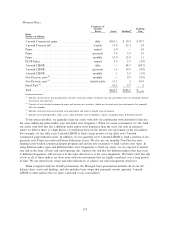

FFELP

Stafford and

PLUS

FFELP

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2005

Fair value of Residual Interests

(2)

.......... $ 774 $ 483 $ 1,149 $ 2,406

Underlying securitized loan balance

(3)

....... 20,372 10,272 8,946 39,590

Weighted average life ................... 2.7yrs. 8.0 yrs. 7.8 yrs.

Prepayment speed (annual rate)

(4)

.......... 10%-20%

(6)

6% 4%

Expected credit losses (% of student loan

principal) .......................... .14% .23% 4.74%

Residual cash flows discount rate .......... 12.3% 10.3% 12.4%

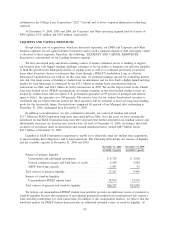

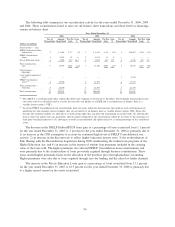

(1)

Includes $151 million and $235 million related to the fair value of the Embedded Floor Income as of December 31, 2006 and

2005, respectively. Changes in the fair value of the Embedded Floor Income are primarily due to changes in the interest rates and

the paydown of the underlying loans.

(2)

At December 31, 2006 and 2005, we had unrealized gains (pre-tax) in accumulated other comprehensive income of $389 million

and $370 million, respectively, that primarily related to the Residual Interests.

(3)

In addition to student loans in off-balance sheet trusts, we had $48.6 billion and $40.9 billion of securitized student loans

outstanding (face amount) as of December 31, 2006 and 2005, respectively, in on-balance sheet FFELP Consolidation Loan

securitization trusts.

(4)

Effective December 31, 2006, we implemented CPR curves for Residual Interest valuations that are based on the number of

months since entering repayment that better reflect the CPR as the loan seasons. Under this methodology, a different CPR is

applied to each year of a loan’s seasoning. Previously, we applied a CPR that was based on a static life of loan assumption,

irrespective of seasoning, or, in the case of FFELP Stafford and PLUS loans, we used a vector approach in applying the CPR. The

change in CPR methodology resulted in an immaterial change in the fair value of the Residual Interest. The CPR assumption used

for all periods includes the impact of projected defaults.

(5)

The repayment status CPR depends on the number of months since first entering repayment or as the loan seasons through the

portfolio. Life of loan CPR is related to repayment status only and does not include the impact of the loan while in interim status.

(6)

The CPRs used for December 31, 2005 FFELP Stafford and PLUS valuations were 20 percent for 2006, 15 percent for 2007 and

10 percent thereafter.

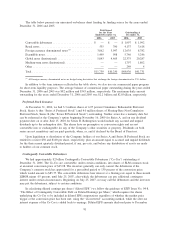

(7)

During 2006, the Company and others in the industry began consolidating Private Education Loans. As a result we experienced an

increase in actual prepayment speeds primarily related to this new consolidation activity. We expect such consolidation activity to

continue going forward and, as a result, the life of loan CPR assumption was increased from 4 percent to 6 percent as of

December 31, 2006. As of December 31, 2006, $304 million of the $389 million in accumulated other comprehensive income

relates to the Private Education Loan trusts.

95