Sallie Mae 2006 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

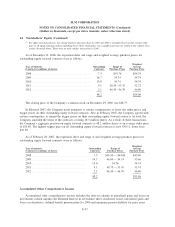

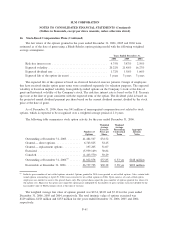

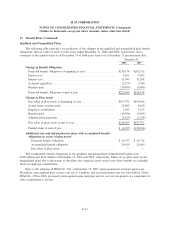

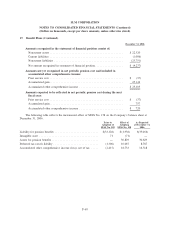

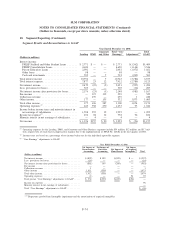

Qualified and Nonqualified Plans

The following tables provide a reconciliation of the changes in the qualified and nonqualified plan benefit

obligations and fair value of assets for the years ended December 31, 2006 and 2005, respectively, and a

statement of the funded status as of December 31 of both years based on a December 31 measurement date.

2006 2005

December 31,

Change in Benefit Obligation

Projected benefit obligation at beginning of year.................... $216,138 $202,352

Service cost............................................... 8,291 9,893

Interest cost............................................... 11,445 11,208

Actuarial (gain)/loss......................................... (2,274) 2,380

Benefits paid .............................................. (10,994) (9,695)

Projected benefit obligation at end of year ........................ $222,606 $216,138

Change in Plan Assets

Fair value of plan assets at beginning of year ...................... $197,972 $199,816

Actual return on plan assets ................................... 31,805 8,160

Employer contribution ....................................... 1,015 1,225

Benefits paid .............................................. (10,994) (9,695)

Administrative payments ..................................... (1,429) (1,534)

Fair value of plan assets at end of year . . . ........................ $218,369 $197,972

Funded status at end of year................................... $ (4,237) $ (18,166)

Additional year-end information for plans with accumulated benefit

obligations in excess of plan assets:

Projected benefit obligation ................................. $ 26,757 $ 25,716

Accumulated benefit obligation .............................. 24,819 21,869

Fair value of plan assets .................................... — —

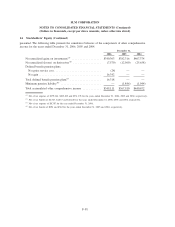

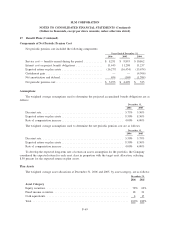

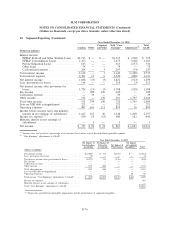

The accumulated benefit obligations of the qualified and nonqualified defined benefit plans were

$218 million and $211 million at December 31, 2006 and 2005, respectively. There are no plan assets in the

nonqualified plans due to the nature of the plans; the corporate assets used to pay these benefits are included

above in employer contributions.

Prior to the adoption of SFAS No. 158, at December 31, 2005, unrecognized net actuarial gains were

$8 million, unrecognized prior service cost was $.1 million, and accrued pension cost was $26 million. Under

SFAS No. 158 in 2006, previously unrecognized gains and prior service cost are recognized as a component of

other comprehensive income.

F-67

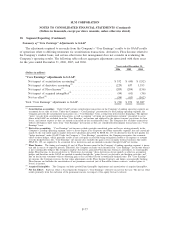

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

17. Benefit Plans (Continued)