Sallie Mae 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

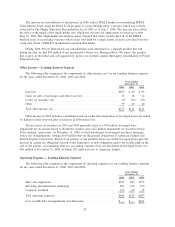

2004 have been retroactively restated to give effect to the application of EITF No. 04-8 as it relates to the

Company’s $2 billion in Co-Cos issued in May 2003.

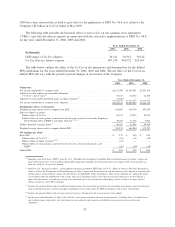

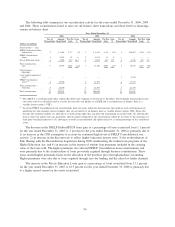

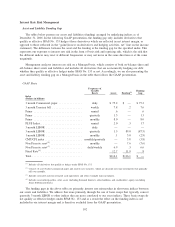

The following table provides the historical effect of our Co-Cos on our common stock equivalents

(“CSEs”) and after-tax interest expense in connection with the retroactive implementation of EITF No. 04-8

for the years ended December 31, 2006, 2005 and 2004.

2006 2005 2004

Years Ended December 31,

(In thousands)

CSE impact of Co-Cos (shares) ........................... 30,312 30,312 30,312

Co-Cos after-tax interest expense .......................... $67,274 $44,572 $21,405

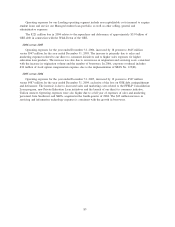

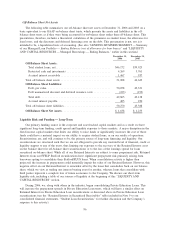

The table below outlines the effect of the Co-Cos on the numerators and denominators for the diluted

EPS calculations for the years ended December 31, 2006, 2005 and 2004. The net effect of the Co-Cos on

diluted EPS will vary with the period to period changes in net income of the Company.

2006 2005 2004

Years Ended December 31,

Numerator:

Net income attributable to common stock .................................... $1,121,389 $1,360,381 $1,901,769

Adjusted for debt expense of convertible debentures

(“Co-Cos”), net of taxes

(1)

............................................ 67,274 44,572 21,405

Adjusted for non-taxable unrealized gains on equity forwards

(2)

...................... (3,528) — —

Net income attributable to common stock, adjusted . . . ........................... $1,185,135 $1,404,953 $1,923,174

Denominator (shares in thousands):

Weighted average shares used to compute basic EPS . . ........................... 410,805 418,374 436,133

Effect of dilutive securities:

Dilutive effect of Co-Cos . . . .......................................... 30,312 30,312 30,312

Dilutive effect of stock options, nonvested restricted stock, restricted stock units, Employee

Stock Purchase Plan (“ESPP”) and equity forwards

(2)(3)(4)

...................... 10,053 11,574 9,342

Dilutive potential common shares

(5)

........................................ 40,365 41,886 39,654

Weighted average shares used to compute diluted EPS. ........................... 451,170 460,260 475,787

Net earnings per share:

Basic EPS ........................................................ $ 2.73 $ 3.25 $ 4.36

Dilutive effect of Co-Cos

(1)

............................................ (.03) (.11) (.23)

Dilutive effect of equity forwards

(2)(4)

..................................... (.01) — —

Dilutive effect of stock options, nonvested restricted stock, restricted stock units, and

ESPP

(3)

....................................................... (.06) (.09) (.09)

Diluted EPS . . . .................................................... $ 2.63 $ 3.05 $ 4.04

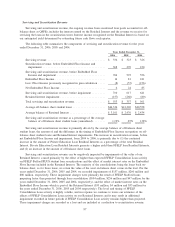

(1)

Emerging Issues Task Force (“EITF”) Issue No. 04-8, “The Effect of Contingently Convertible Debt on Diluted Earnings per Share,” requires the

shares underlying Co-Cos to be included in diluted EPS computations regardless of whether the market price trigger or the conversion price has

been met, using the “if-converted” method.

(2)

SFAS No. 128, “Earnings per Share,” and the additional guidance provided by EITF Topic No. D-72, “Effect of Contracts That May Be Settled in

Stock or Cash on the Computation of Diluted Earnings per Share,” require both the denominator and the numerator to be adjusted in calculating the

potential impact of the Company’s equity forward contracts on diluted EPS. Under this guidance, when certain conditions are satisfied, the impact

can be dilutive when the combination of the average share price during the period is lower than the respective strike prices on the Company’s

equity forward contracts, and when the reversal of an unrealized gain or loss on derivative and hedging activities related to its equity forward

contracts results in a lower EPS calculation.

(3)

Includes the potential dilutive effect of additional common shares that are issuable upon exercise of outstanding stock options, nonvested restricted

stock, restricted stock units, and the outstanding commitment to issue shares under the ESPP, determined by the treasury stock method.

(4)

Includes the potential dilutive effect of equity forward contracts, determined by the reverse treasury stock method.

(5)

For the years ended December 31, 2006, 2005 and 2004, stock options and equity forwards of approximately 57 million shares, 30 million shares

and 4 million shares, respectively, were outstanding but not included in the computation of diluted earnings per share because they were

antidilutive.

92