Sallie Mae 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

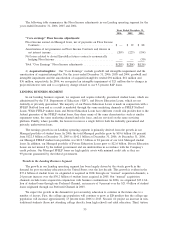

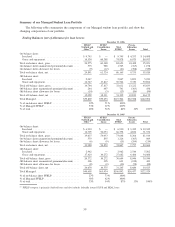

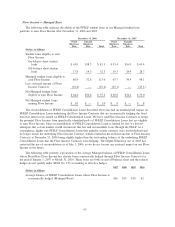

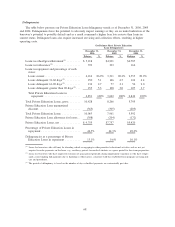

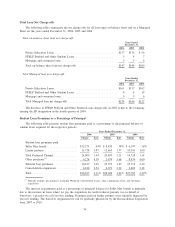

Floor Income — Managed Basis

The following table analyzes the ability of the FFELP student loans in our Managed student loan

portfolio to earn Floor Income after December 31, 2006 and 2005

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

December 31, 2006 December 31, 2005

(Dollars in billions)

Student loans eligible to earn

Floor Income:

On-balance sheet student

loans ................... $63.0 $18.3 $ 81.3 $ 53.4 $16.0 $ 69.4

Off-balance sheet student

loans ................... 17.8 14.5 32.3 10.3 18.4 28.7

Managed student loans eligible to

earn Floor Income ........... 80.8 32.8 113.6 63.7 34.4 98.1

Less: notional amount of Floor

Income Contracts ........... (16.4) — (16.4) (25.1) — (25.1)

Net Managed student loans

eligible to earn Floor Income. . . $ 64.4 $32.8 $ 97.2 $ 38.6 $34.4 $ 73.0

Net Managed student loans

earning Floor Income ........ $ 1.0 $ — $ 1.0 $ .8 $ — $ .8

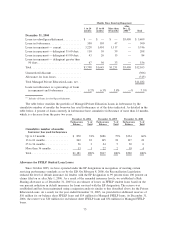

The reconsolidation of FFELP Consolidation Loans described above has had an unanticipated impact on

FFELP Consolidation Loans underlying the Floor Income Contracts that are economically hedging the fixed

borrower interest rate earned on FFELP Consolidation Loans. We have sold Floor Income Contracts to hedge

the potential Floor Income from specifically identified pools of FFELP Consolidation Loans that are eligible

to earn Floor Income. Since reconsolidation of FFELP Consolidation Loans is limited by law, we did not

anticipate that certain lenders would circumvent this law and reconsolidate loans through the FDLP. As a

consequence, higher rate FFELP Consolidation Loans that underlie certain contracts were reconsolidated and

no longer match the underlying Floor Income Contract, which resulted in the notional amount of Floor Income

Contracts at December 31, 2006 being slightly higher than the outstanding balance of the underlying FFELP

Consolidation Loans that the Floor Income Contracts were hedging. The Higher Education Act of 2005 has

restricted the use of reconsolidation as of July 1, 2006, so we do not foresee any material impact on our Floor

Income in the future.

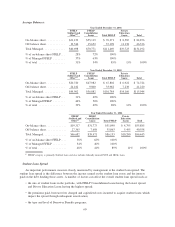

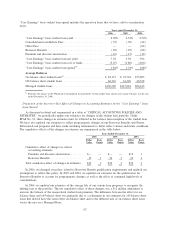

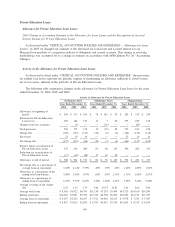

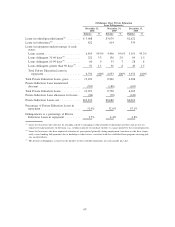

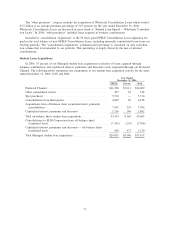

The following table presents a projection of the average Managed balance of FFELP Consolidation Loans

whose Fixed Rate Floor Income has already been economically hedged through Floor Income Contracts for

the period January 1, 2007 to March 31, 2010. These loans are both on and off-balance sheet and the related

hedges do not qualify under SFAS No. 133 accounting as effective hedges.

2007 2008 2009 2010

(Dollars in billions)

Average balance of FFELP Consolidation Loans whose Floor Income is

economically hedged (Managed Basis) ....................... $16 $15 $10 $2

65