Sallie Mae 2006 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

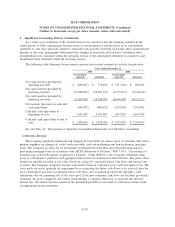

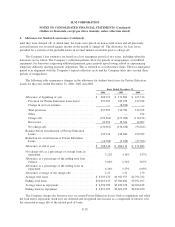

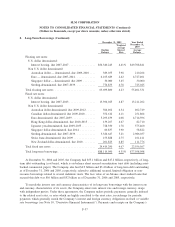

4. Allowance for Student Loan Losses (Continued)

until they were charged off, at which time, the loans were placed on non-accrual status and all previously

accrued interest was reversed against income in the month of charge-off. The allowance for loan losses

provided for a portion of the probable losses in accrued interest receivable prior to charge-off.

The Company’s loss estimates are based on a loss emergence period of two years, including when the

borrowers are in school. The Company’s collection policies allow for periods of nonpayment, or modified

repayment, for borrowers requesting additional payment grace periods upon leaving school or experiencing

temporary difficulty meeting payment obligations. This is referred to as forbearance status. The loss emergence

period is in alignment with the Company’s typical collection cycle and the Company takes into account these

periods of nonpayment.

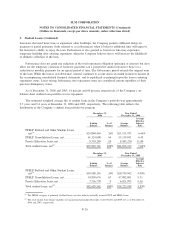

The following table summarizes changes in the allowance for student loan losses for Private Education

Loans for the years ended December 31, 2006, 2005 and 2004.

2006 2005 2004

Years Ended December 31,

Allowance at beginning of year.................... $ 204,112 $ 171,886 $ 165,716

Provision for Private Education Loan losses ........ 257,983 185,078 129,768

Change in net loss estimate..................... — (8,296) —

Total provision .............................. 257,983 176,782 129,768

Other ..................................... — — 372

Charge-offs ................................ (159,560) (153,994) (110,271)

Recoveries ................................. 22,599 19,366 14,007

Net charge-offs.............................. (136,961) (134,628) (96,264)

Balance before securitization of Private Education

Loans..................................... 325,134 214,040 199,592

Reduction for securitization of Private Education

Loans..................................... (16,788) (9,928) (27,706)

Allowance at end of year ........................ $ 308,346 $ 204,112 $ 171,886

Net charge-offs as a percentage of average loans in

repayment ................................. 3.22% 4.14% 3.57%

Allowance as a percentage of the ending total loan

balance ................................... 3.06% 2.56% 3.07%

Allowance as a percentage of the ending loans in

repayment ................................. 6.36% 5.57% 6.05%

Allowance coverage of net charge-offs .............. 2.25 1.52 1.79

Average total loans............................. $ 8,585,270 $6,921,975 $4,794,782

Ending total loans ............................. $10,063,635 $7,960,882 $5,591,497

Average loans in repayment ...................... $ 4,256,780 $3,252,238 $2,696,818

Ending loans in repayment ....................... $ 4,851,305 $3,662,255 $2,842,220

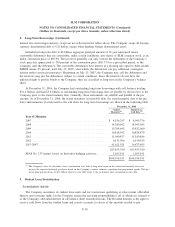

The Company charges the borrower fees on certain Private Education Loans, both at origination and when

the loan enters repayment. Such fees are deferred and recognized into income as a component of interest over

the estimated average life of the related pool of loans.

F-28

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)