Sallie Mae 2006 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

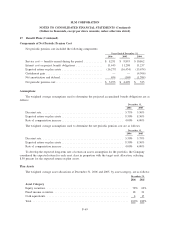

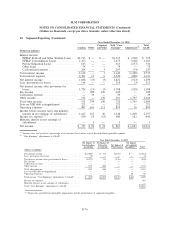

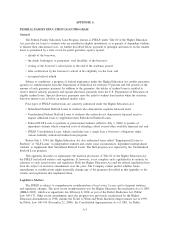

19. Income Taxes (Continued)

At December 31, 2006 and 2005, the tax effect of temporary differences that give rise to deferred tax

assets and liabilities include the following:

2006 2005

December 31,

Deferred tax assets:

Loan reserves ............................................. $321,467 $208,343

Market value adjustments on investments ......................... 279,347 184,313

Deferred revenue ........................................... 59,825 138,102

Accrued expenses not currently deductible ........................ 57,863 55,452

Operating loss and credit carryovers ............................. 57,125 5,738

Warrants issuance .......................................... 42,132 49,448

Stock-based compensation plans................................ 34,054 6,328

Partnership income ......................................... 21,629 35,568

Loan origination services ..................................... 12,652 17,706

In-substance defeasance transactions ............................ — 4,718

Other.................................................... 29,664 24,521

Total deferred tax assets...................................... 915,758 730,237

Deferred tax liabilities:

Securitization transactions .................................... 387,290 132,879

Unrealized investment gains recorded to other comprehensive income .... 183,684 197,834

Contingent payment debt instruments ............................ 100,632 78,934

Leases ................................................... 92,382 155,889

Depreciation/amortization .................................... 57,856 51,987

In-substance defeasance transactions ............................ 9,930 —

Other.................................................... 9,085 10,128

Total deferred tax liabilities ................................... 840,859 627,651

Net deferred tax assets ....................................... $ 74,899 $102,586

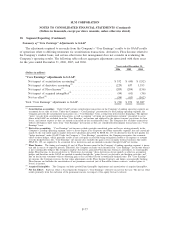

Included in other deferred tax assets is a valuation allowance of $3,778 and $0 as of December 31, 2006

and 2005, respectively, against a portion of the Company’s state deferred tax assets. The ultimate realization of

the deferred tax assets is dependent upon the generation of future taxable income during the period in which

the temporary differences become deductible. Management primarily considers the scheduled reversals of

deferred tax liabilities and the history of positive taxable income in making this determination. The valuation

allowance primarily relates to state deferred tax assets for which subsequently recognized tax benefits will be

allocated to goodwill.

As of December 31, 2006, the Company has federal net operating loss carryforwards of $134,859 which

begin to expire in 2021, apportioned state net operating loss carryforwards of $130,407 which begin to expire

in 2007, and federal and state credit carryovers of $1,279 which begin to expire in 2020.

During 2006, the Company and the IRS reached agreement with regard to all open issues associated with

the examination of the Company’s 2002 and prior year U.S. federal income tax returns. The IRS is currently

completing its examination of the Company’s 2003 and 2004 U.S. federal income tax returns.

F-79

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)