Sallie Mae 2006 Annual Report Download - page 36

Download and view the complete annual report

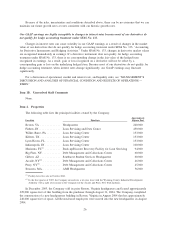

Please find page 36 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.uncollectible accrued interest on Private Education Loans and write off that amount against current period

interest income.

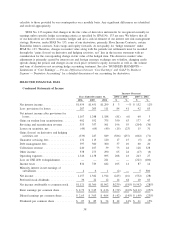

When calculating the allowance for loan loses on Private Education Loan loss, we divide the portfolio

into categories of similar risk characteristics based on loan program type, loan status (in-school, grace,

repayment, forbearance, delinquency), underwriting criteria, existence or absence of a co-borrower, and aging.

We then apply default and collection rate projections to each category. Our higher education Private Education

Loan programs (90 percent of the Managed Private Education Loan portfolio at December 31, 2006) do not

require the borrowers to begin repayment until six months after they have graduated or otherwise left school.

Consequently, our loss estimates for these programs are minimal while the borrower is in school. Our career

training and alternative Private Education Loan programs (10 percent of the Managed Private Education Loan

portfolio at December 31, 2006) generally require the borrowers to start repaying their loans immediately. At

December 31, 2006, 46 percent of the principal balance in the higher education Managed Private Education

Loan portfolio is related to borrowers who are still in-school and not required to make payments. As the

current portfolio ages, an increasing percentage of the borrowers will leave school and be required to begin

payments on their loans. The allowance for losses will change accordingly with the percentage of borrowers in

repayment.

Our loss estimates are based on a loss emergence period of two years. Similar to the rules governing

FFELP payment requirements, our collection policies allow for periods of nonpayment for borrowers

requesting additional payment grace periods upon leaving school or experiencing temporary difficulty meeting

payment obligations. This is referred to as forbearance status and is considered separately in our allowance of

loan losses. The majority of forbearance occurs early in the repayment term when borrowers are starting their

careers (see “LENDING BUSINESS SEGMENT — Private Education Loans — Delinquencies”). At Decem-

ber 31, 2006, 9 percent of the Managed Private Education Loan portfolio in repayment and forbearance was in

forbearance status. The loss emergence period is in alignment with our typical collection cycle and takes into

account these periods of nonpayment.

In general, Private Education Loan principal is charged off against the allowance when the loan exceeds

212 days delinquency. Recoveries on loans charged off are considered when calculating the allowance for loan

losses, and actual cash recoveries are therefore recorded directly to the allowance.

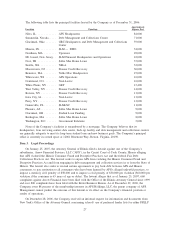

As a result of Sallie Mae Servicing’s Exceptional Performer (“EP”) designation for ED, the Company

received 100 percent reimbursement (declining to 99 percent on July 1, 2006 under the Reconciliation

Legislation, discussed below) on default claims on federally guaranteed student loans that are serviced by

Sallie Mae Servicing for a period of at least 270 days before the date of default. The Company is entitled to

receive this benefit as long as the Company remains in compliance with the required servicing standards,

which are assessed on an annual and quarterly basis through compliance audits and other criteria. The EP

designation applies to all FFELP loans that are serviced by the Company as well as default claims on federally

guaranteed student loans that the Company owns but are serviced by other service providers with the EP

designation.

The Reconciliation Legislation, signed into law on February 8, 2006, reduced the level of default

insurance from 98 percent to 97 percent (effectively increasing Risk Sharing from two percent to three

percent) on loans disbursed after July 1, 2006 for lenders without the EP designation. Furthermore, the bill

reduced the default insurance paid to lenders/servicers with the EP designation to 99 percent from 100 percent

on claims filed on or after July 1, 2006. As a result of the amended insurance levels, we established a Risk

Sharing allowance as of December 31, 2005 for an estimate of losses on FFELP student loans based on the

one percent reduction in default insurance for servicers with the EP designation. The reserve was established

using a migration analysis similar to that described above for the Private Education Loans before applying the

appropriate Risk Sharing percentage.

The evaluation of the provisions for loan losses is inherently subjective, as it requires material estimates

that may be susceptible to significant changes. Management believes that the allowance for loan losses is

appropriate to cover probable losses in the student loan portfolio.

35