Sallie Mae 2006 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

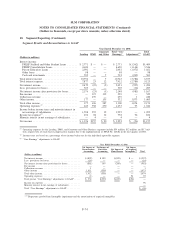

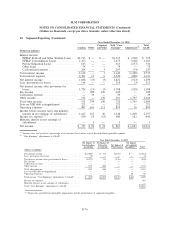

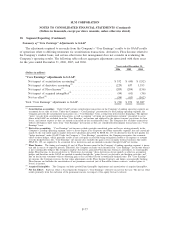

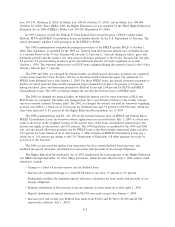

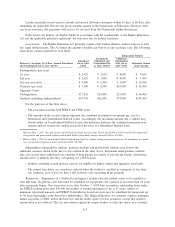

21. Restatement of Quarterly Consolidated Statements of Cash Flows (unaudited)

The following tables set forth the effects of the restatement of the quarterly consolidated statements of

cash flows for the quarters in 2006 and 2005. See also Note 2, “Significant Accounting Policies — Statement

of Cash Flows — Restatement of the Consolidated Statements of Cash Flows.”

(Dollars in thousands)

As Previously

Reported Restated

As Previously

Reported Restated

2006 2005

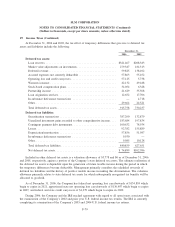

Three Months Ended March 31,

Operating activities

Net income ................................................. $ 151,601 $ 151,601 $ 223,384 $ 223,384

Adjustments to reconcile net income to net cash used in operating activities:

Gains on student loan securitizations . . .............................. (30,023) (30,023) (49,894) (49,894)

Losses on securities, net . ....................................... — 2,948 — 2,199

Stock-based compensation cost . . .................................. — 22,768 — 5,036

Unrealized (gains)/losses on derivative and hedging activities, excluding equity

forwards ................................................ (83,332) (83,332) (196,516) (196,516)

Unrealized (gains)/losses on derivative and hedging activities — equity forwards ...... 122,411 122,411 108,307 108,307

Provisions for losses . . . ....................................... 60,319 60,319 46,523 46,523

Minority interest, net . . . ....................................... (1,674) (1,674) (2,284) (2,284)

Mortgage loans originated ....................................... (349,332) (349,332) (368,737) (368,737)

Proceeds from sales of mortgage loans . .............................. 368,008 368,008 280,793 280,793

(Increase) decrease in restricted cash-other . . ........................... 22,120 (63,629) (103,246) 19,567

(Increase) in accrued interest receivable . .............................. (233,427) (233,427) (110,922) (110,922)

Increase in accrued interest payable . . . .............................. 30,253 30,253 7,195 7,195

Decrease in Retained Interest in off-balance sheet securitized loans, net . .......... 52,524 52,524 9,165 9,165

(Increase) decrease in other assets, goodwill and acquired intangible assets, net . ...... (95,061) (66,988) 53,637 76,828

(Decrease) in other liabilities . . . .................................. (214,854) (193,826) (29,932) (29,932)

Total adjustments ............................................ (352,068) (363,000) (355,911) (202,672)

Net cash (used in) provided by operating activities ........................ (200,467) (211,399) (132,527) 20,712

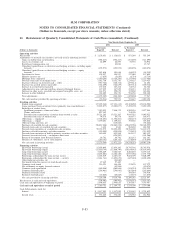

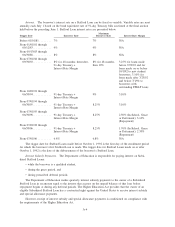

Investing activities

Student loans acquired . . ....................................... (8,336,703) (8,322,746) (7,396,513) (7,385,964)

Loans purchased from securitized trusts (primarily loan consolidations) . . .......... (1,338,498) (1,338,498) (1,831,300) (1,831,300)

Reduction of student loans:

Installment payments, claims and other. . . ........................... 2,213,562 2,494,862 1,419,656 1,702,842

Claims and resales . . . ....................................... 281,300 — 283,186 —

Proceeds from securitization of student loans treated as sales . ............... 7,985,275 7,985,275 3,544,305 3,544,305

Proceeds from sales of student loans . .............................. 9,214 9,214 14,709 14,709

Other loans-originated . . ....................................... (289,585) (289,585) (116,791) (116,791)

Other loans-repaid ........................................... 295,396 295,396 156,589 156,589

Other investing activities, net . . . .................................. — (33,065) — (40,306)

Purchases of available-for-sale securities .............................. (10,290,599) (10,263,898) (28,684,462) (28,655,855)

Proceeds from sales of available-for-sale securities ........................ — — 841,797 482,944

Proceeds from maturities of available-for-sale securities . .................... 10,810,275 10,811,460 28,955,447 29,314,300

Purchases of held-to-maturity and other securities ......................... (235,804) (235,804) (150,388) (150,388)

Proceeds from maturities of held-to-maturity securities and other securities . . . ...... 191,556 176,344 155,973 155,973

Decrease (increase) in restricted cash — on-balance sheet trusts . ............... — 100,961 — (122,813)

Return of investment from Retained Interest . . . ......................... 36,580 36,580 73,196 73,196

Net cash provided by (used in) investing activities ........................ 1,331,969 1,426,496 (2,734,596) (2,858,559)

Financing activities

Short-term borrowings issued . . . .................................. 15,294,416 15,290,752 4,568,130 4,568,130

Short-term borrowings repaid . . . .................................. (15,297,685) (15,297,685) (2,921,784) (2,921,784)

Long-term borrowings issued . . . .................................. 1,658,926 1,653,839 1,664,501 1,660,336

Long-term borrowings repaid . . . .................................. (1,800,449) (1,763,784) (2,559,972) (100,103)

Borrowings collateralized by loans in trust issued ......................... — — — —

Borrowings collateralized by loans in trust — activity . ..................... (1,042,156) (1,082,549) (337,420) (2,800,577)

Other financing activities, net . . . .................................. — (22,681) — —

Tax benefit from the exercise of stock-based awards . . . .................... 17,108 17,108 — —

Common stock issued . . ....................................... 106,522 71,942 56,244 46,969

Net settlements on equity forward contracts . . . ......................... — (13,855) — (12,548)

Common stock repurchased ...................................... (181,846) (181,846) (179,386) (179,386)

Common dividends paid . ....................................... (91,473) (91,473) (79,933) (79,933)

Preferred dividends paid . ....................................... (8,142) (8,142) (2,875) (2,875)

Net cash (used in) provided by financing activities ........................ (1,344,779) (1,428,374) 207,505 178,229

Net decrease in cash and cash equivalents . .............................. (213,277) (213,277) (2,659,618) (2,659,618)

Cash and cash equivalents at beginning of period . ......................... 2,498,655 2,498,655 3,395,487 3,395,487

Cash and cash equivalents at end of period ............................ $ 2,285,378 $ 2,285,378 $ 735,869 $ 735,869

Cash disbursements made for:

Interest . ................................................. $ 1,022,758 $ 1,022,758 $ 437,243 $ 437,243

Income taxes . . . ............................................ $ 148,597 $ 148,597 $ 12,384 $ 12,384

F-81

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)