Sallie Mae 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

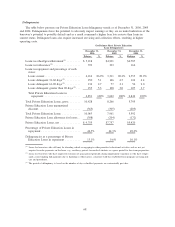

1to24

months

25 to 48

months

More than

48 months

After

Dec. 31,

2004

(1)

Total

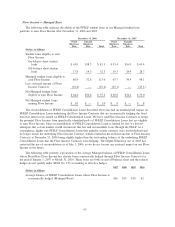

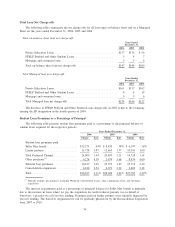

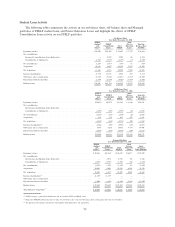

Months Since Entering Repayment

December 31, 2004

Loans in-school/grace/deferment ........... $ — $ — $ — $5,409 $ 5,409

Loans in forbearance.................... 350 103 47 — 500

Loans in repayment — current............. 3,228 1,401 1,117 — 5,746

Loans in repayment — delinquent 31-60 days. . 110 59 39 — 208

Loans in repayment — delinquent 61-90 days. . 43 26 15 — 84

Loans in repayment — delinquent greater than

90 days ............................ 67 56 33 — 156

Total ............................... $3,798 $1,645 $1,251 $5,409 $12,103

Unamortized discount ................... (306)

Allowance for loan losses ................ (315)

Total Managed Private Education Loans, net . . $11,482

Loans in forbearance as a percentage of loans

in repayment and forbearance ........... 9.2% 6.3% 3.8% —% 7.5%

(1)

Includes all loans in-school/grace/deferment.

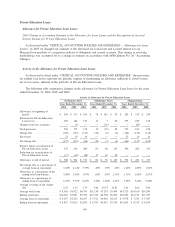

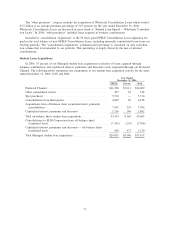

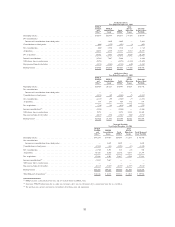

The table below stratifies the portfolio of Managed Private Education Loans in forbearance by the

cumulative number of months the borrower has used forbearance as of the dates indicated. As detailed in the

table below, 4 percent of loans currently in forbearance have cumulative forbearance of more than 24 months,

which is a decrease from the prior two years.

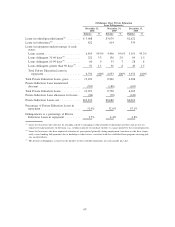

Forbearance

Balance

%of

Total

Forbearance

Balance

%of

Total

Forbearance

Balance

%of

Total

December 31, 2006 December 31, 2005 December 31, 2004

Cumulative number of months

borrower has used forbearance

Up to 12 months .............. $ 870 74% $686 75% $334 66%

13 to 24 months ............... 262 22 165 18 117 24

25 to 36 months ............... 36 3 44 5 30 6

More than 36 months ........... 13 1 22 2 19 4

Total ....................... $1,181 100% $917 100% $500 100%

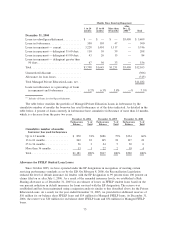

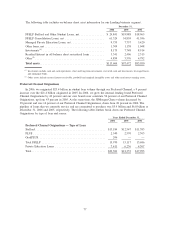

Allowance for FFELP Student Loan Losses

Since October 2005, we have operated under the EP designation in recognition of meeting certain

servicing performance standards as set by the ED. On February 8, 2006, the Reconciliation Legislation

reduced the level of default insurance for lenders with the EP designation to 99 percent from 100 percent on

claims filed on or after July 1, 2006. As a result of the amended insurance levels, we established a Risk

Sharing allowance as of December 31, 2005 for an estimate of losses on FFELP student loans based on the

one percent reduction in default insurance for loans serviced with the EP designation. The reserve was

established and has been maintained using a migration analysis similar to that described above for the Private

Education Loans. As a result, for the year ended December 31, 2005, we provided for additional reserves of

$10 million for on-balance sheet FFELP loans and $19 million for Managed FFELP loans. At December 31,

2006, the reserve was $20 million for on-balance sheet FFELP loans and $34 million for Managed FFELP

loans.

73