Sallie Mae 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEBT MANAGEMENT OPERATIONS (“DMO”) BUSINESS SEGMENT

In our DMO operating segment, we provide a wide range of accounts receivable and collections services

including student loan default aversion services, defaulted student loan portfolio management services,

contingency collections services for student loans and other asset classes, and accounts receivable management

and collection for purchased portfolios of receivables that are delinquent or have been charged off by their

original creditors as well as sub-performing and non-performing mortgage loans. In the purchased receivables

business, we focus on a variety of consumer debt types with emphasis on charged off credit card receivables

and distressed mortgage receivables. We purchase these portfolios at a discount to their face value, and then

use both our internal collection operations coupled with third party collection agencies to maximize the

recovery on these receivables.

We account for our investments in charged off receivables in accordance with the AICPA’s Statement of

Position (“SOP”) 03-3, “Accounting for Certain Loans or Debt Securities Acquired in a Transfer.” Under this

standard, we establish static pools of each quarter’s purchases and aggregate them based on certain common

risk characteristics and initially record them at fair value based on the pool’s estimated future cash flow and

internal rate of return. Under SOP 03-3, the yield that may be accreted as collections revenue on such loans is

limited to the excess of our estimate of undiscounted expected principal, interest and other cash flows from

the pool over our initial investment in the pool. We recognize income each month based on each static pool’s

effective interest rate. The static pools are tested quarterly for impairment by re-estimating the future cash

flows to be received from the pools. Subsequent increases in estimated future cash flows are recognized

prospectively through a yield adjustment over the remaining life of the static pool. When estimates of future

cash flows to be collected are projected to be lower than projected, the carrying value of the pool is impaired

and written down through a valuation allowance to maintain the effective interest rate. Cash collected on pools

whose principal has fully amortized is recognized 100 percent in income.

The private sector collections industry is highly fragmented with few large public companies and a large

number of small scale privately-held companies. The collections industry is highly competitive with credit card

collections being the most competitive in both contingency collections and purchased paper activities. We are

responding to these competitive challenges through enhanced servicing efficiencies and by continuing to build

on customer relationships through value added services and financings.

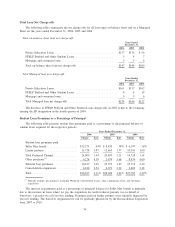

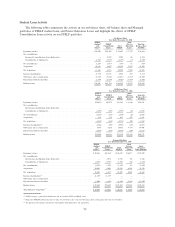

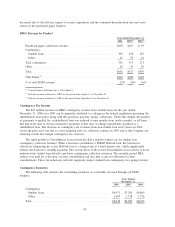

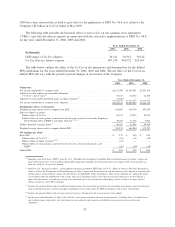

The following table includes the results of operations for our DMO operating segment.

Condensed Statements of Income

2006 2005 2004

2006 vs.

2005

2005 vs.

2004

Years Ended

December 31,

% Increase

(Decrease)

Fee income......................................... 397 360 300 10 20

Collections revenue................................... 239 167 39 43 328

Total income ....................................... 636 527 339 21 55

Operating expenses ................................... 358 288 161 24 79

Net interest expense . . . ............................... 23 19 13 21 46

Income before income taxes and minority interest in net earnings

of subsidiaries ..................................... 255 220 165 16 33

Income taxes ....................................... 94 81 65 15 25

Income before minority interest in net earnings of subsidiaries . . . 161 139 100 16 39

Minority interest in net earnings of subsidiaries .............. 4 4 1 — 300

Net income......................................... $157 $135 $ 99 16% 36%

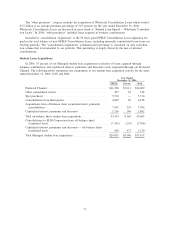

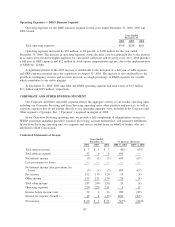

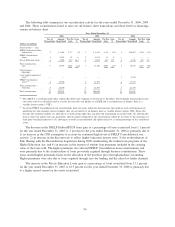

Revenues from USA Funds represented 32 percent, 34 percent and 56 percent, respectively, of total DMO

revenue in 2006, 2005 and 2004. The percentage of revenue generated from services provided to USA Funds

84