Sallie Mae 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

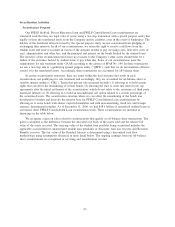

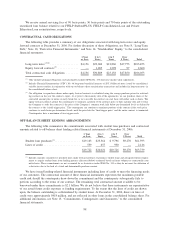

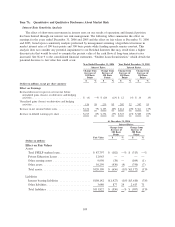

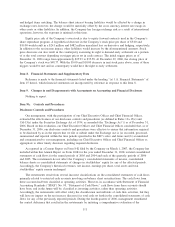

Managed Basis

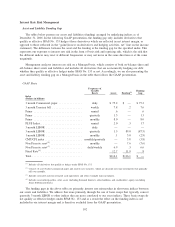

Frequency of

Variable

Resets Assets Funding

(1)

Funding

Gap

Index

(Dollars in billions)

3 month Commercial paper ................... daily $101.1 $ 10.4 $ 90.7

3 month Treasury bill ....................... weekly 13.9 12.5 1.4

Prime ................................... annual 1.0 — 1.0

Prime ................................... quarterly 7.4 5.5 1.9

Prime ................................... monthly 13.9 12.8 1.1

PLUS Index .............................. annual 3.5 5.5 (2.0)

3-month LIBOR ........................... daily — 84.7 (84.7)

3-month LIBOR ........................... quarterly 1.5 10.5 (9.0)

1-month LIBOR ........................... monthly .1 2.0 (1.9)

Non Discrete reset

(2)

........................ monthly — 9.9 (9.9)

Non Discrete reset

(3)

........................ daily/weekly 11.1 .2 10.9

Fixed Rate

(4)

.............................. 10.2 9.7 .5

Total .................................... $163.7 $163.7 $ —

(1)

Includes all derivatives that management considers economic hedges of interest rate risk and reflects how we internally manage

our interest rate exposure.

(2)

Consists of asset-backed commercial paper and auction rate securities, which are discount note type instruments that generally

roll over monthly.

(3)

Includes restricted and non-restricted cash equivalents and other overnight type instruments.

(4)

Includes receivables/payables, other assets, other liabilities and stockholders’ equity (excluding Series B Preferred Stock).

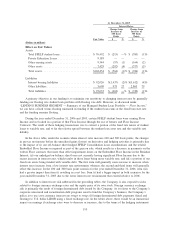

To the extent possible, we generally fund our assets with debt (in combination with derivatives) that has

the same underlying index (index type and index reset frequency). When it is more economical, we also fund

our assets with debt that has a different index and/or reset frequency than the asset, but only in instances

where we believe there is a high degree of correlation between the interest rate movement of the two indices.

For example, we use daily reset 3-month LIBOR to fund a large portion of our daily reset 3-month

commercial paper indexed assets. In addition, we use quarterly reset 3-month LIBOR to fund a portion of our

quarterly reset Prime rate indexed Private Education Loans. We also use our monthly Non Discrete reset

funding (asset-backed commercial paper program and auction rate securities) to fund various asset types. In

using different index types and different index reset frequencies to fund our assets, we are exposed to interest

rate risk in the form of basis risk and repricing risk, which is the risk that the different indices that may reset

at different frequencies will not move in the same direction or at the same magnitude. We believe that this risk

is low as all of these indices are short-term with rate movements that are highly correlated over a long period

of time. We use interest rate swaps and other derivatives to achieve our risk management objectives.

When compared with the GAAP presentation, the Managed basis presentation includes all of our off-

balance sheet assets and funding, and also includes basis swaps that primarily convert quarterly 3-month

LIBOR to other indices that are more correlated to our asset indices.

103